Savings & Investment Strategies

Optimise your Savings and Investment Strategies to make your dreams a reality: Savings and Investment Strategies for Wealth Creation

Whether you’re after education for your children, a world trip, or a weekender on the coast, we all have plans and goals we are working towards.

And we all need to plan for the time when we are no longer earning a regular income. In fact, most people who leave the workforce at age 60 can at least look forward to 30 years in retirement. This can be a time to take up new interests, pursue new opportunities or simply enjoy the fruits of our working life.

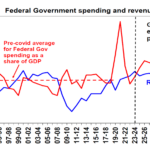

Provided, that is, that we’ve made the right preparations. Australia now faces a rapidly aging population and the Government’s ability to provide everyone with retirement pensions is diminishing.

Today, perhaps more than ever, our future really is in our own hands.

Long term goals require long term financial planning.

We’ll put together Savings and Investment strategies to meet your goals. Options include:

- Defensive Investments. Many investors are attracted to defensive fixed interest investments, such as bank term deposits, because they provide maximum security. However, past performance indicates that with the effect of inflation, fixed interest investments alone may not provide the returns required to achieve long term goals.

- Growth investments. These include shares and property and are long term investments. They offer a more effective choice for long term investors because they have the capacity to increase in capital value as well as provide income streams.

Imagine your peace of mind knowing you have a plan in place to meet your goals. That’s our Goal!