Archives

- March 2025 (6)

Gold is an asset because it represents as store of wealth.

This undisputed fact has been the case for millennia and Gold is also purchased heavily in times of financial fear.

For example, the price of one ounce of Gold has risen to US$3,115 today which is a 39.1% increase in 12 months.

However, the problem with investing in this asset is that Gold does not multiply.

A bar of Gold does not produce baby Gold ingots which means an investor can make no money for extended periods such as between late 1970’s and the 2008 Global Financial Crisis (some 30 plus years) during which time an investor did not make a dollar.

Worst still is the inflation adjusted price of Gold which has seen no real growth for 45 years.

Gold is a terrible asset for multiplying wealth.

The principles of Value Investing teach us to not invest in commodities, Gold might sparkle but it is just too risky.

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances, please do not hesitate to contact us directly.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

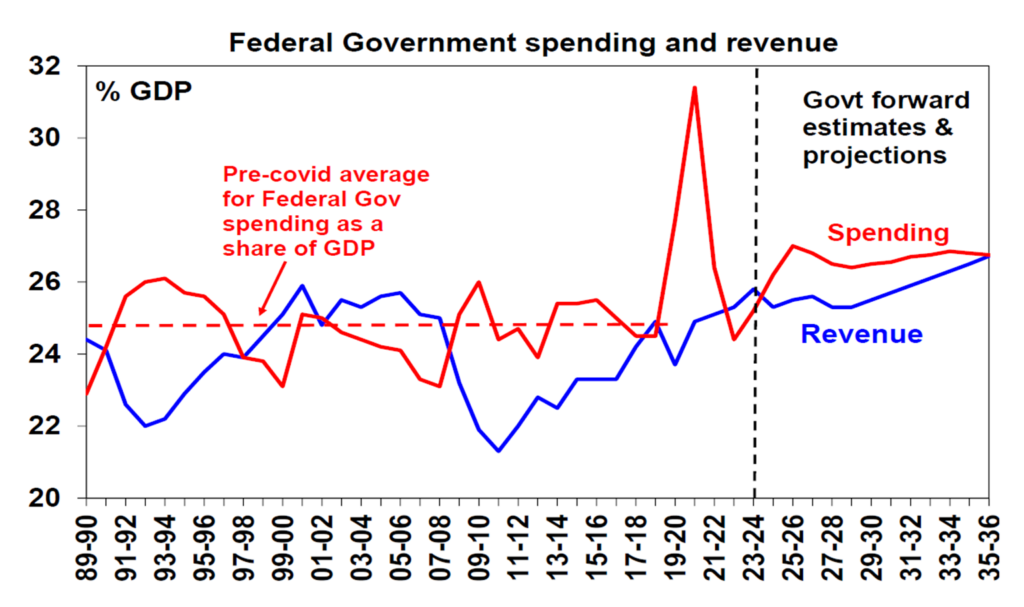

The Federal Treasurer Jim Chalmers has handed down his fourth Budget and it is all about increased spending that is projected to keep the budget in a deficit to 2036 with this year’s budget deficit projected to be AU$26.7 billion.

It is just bad news for business with small businesses missing out on an extension to the $20,000 instant asset write-off and non-compete clauses being voided for employees earning less than AU$175,000 per annum.

It is important to remember that all Budget announcements are currently proposals and will still need to be legislated.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

Clients have been asking us if Donald Trump and his Tariff War is going to cause a recession in the United States.

The actual answer is that we do not know.

The latest probability for a recession in the United States sits at 23% likely which is low and down from last year.

Similarly, Australia is at 20% likely.

Staying in cash and waiting for a recession in our experience almost always fails because the investor is not growing their assets against inflation while they wait.

Our response is to remain invested according to your appetite for risk and then react when the recession does occur because it will present an opportunity to buy more quality assets at a discounted price.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

The printing of vast quantiles of money (issuing I-owe-you paper called notes, bills, bonds) by Central Banks around the World has been the key driver behind Bitcoin and cryptocurrencies but remember that the price of Bitcoin relies on The Greater Fool Theory.

The Greater Fool Theory is where a purchaser/investor buys an item/asset in the belief that the next purchaser/investor will buy it from them at a higher price.

There are only 21 million Bitcoins in total and so far 19.9 million have been collected which makes it rare and as long as there is a group who want to trade in this limited edition rarity (think of it as a collector’s item) there will be a price.

Once there is no longer a group that wants to trade in this collector’s item the price will evaporate.

Remember we have been here before, The Dutch Tulip Bubble (Tulip Mania) 1637.

Before 1633 the tulip trade in Holland had been restricted to professional growers but rising tulip prices tempted both the middle-class and poor families to speculate on tulip prices which went up, and up, and up until finally, the bubble busted when collectors no longer wanted to trade in tulips.

We don’t really know how cryptocurrency will end but we do know what Benjamin Graham taught and that was to not speculate. Instead remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

We have updated our Financial Services Guide.

For more details, click ‘Newealth FSG’ or alternatively go to the FINANCIAL SERVICES GUIDE link at bottom of the page.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

The Australian All Ordinaries Index (AORD) closed at a record high of 8,825 on 14th February 2025 and the Down Jones Industrial Average (DJI) closed at a record high of 45,014 on 4th December 2024.

As at close yesterday and overnight, both indices have fallen 8% which does not even rate as a correction (defined as a fall of 10% from recent peak).

Beware the media, they do like to talk up the drop in dollars becasue it makes for great headlines.

The likelihood that this could develop into a full-blooded crash (defined as a fall of 20% from recent peak) is always a possibility because it is not a matter of if but when will the United States go into its next recession and tariffs are certainly helping push the United States into a recession.

The key for investors as taught by Benjamin Graham is never to panic, invest according to our appetite for volatility and when the next panic takes hold, react by buying more quality assets at discounted prices.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.