Archives

- March 2025 (6)

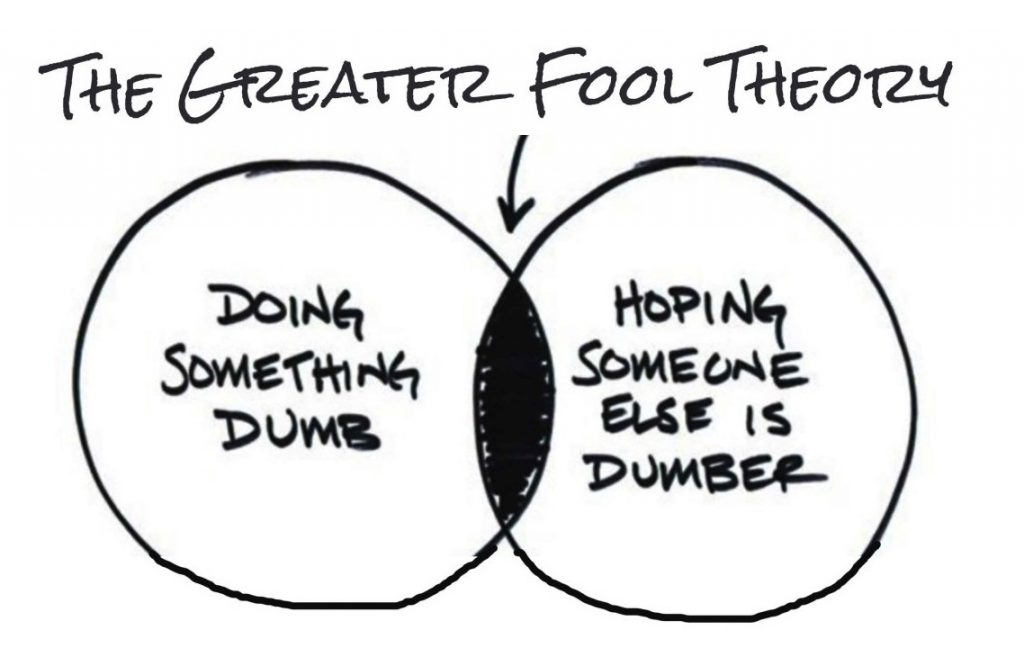

The printing of vast quantiles of money (issuing I-owe-you paper called notes, bills, bonds) by Central Banks around the World has been the key driver behind Bitcoin and cryptocurrencies but remember that the price of Bitcoin relies on The Greater Fool Theory.

The Greater Fool Theory is where a purchaser/investor buys an item/asset in the belief that the next purchaser/investor will buy it from them at a higher price.

There are only 21 million Bitcoins in total and so far 19.9 million have been collected which makes it rare and as long as there is a group who want to trade in this limited edition rarity (think of it as a collector’s item) there will be a price.

Once there is no longer a group that wants to trade in this collector’s item the price will evaporate.

Remember we have been here before, The Dutch Tulip Bubble (Tulip Mania) 1637.

Before 1633 the tulip trade in Holland had been restricted to professional growers but rising tulip prices tempted both the middle-class and poor families to speculate on tulip prices which went up, and up, and up until finally, the bubble busted when collectors no longer wanted to trade in tulips.

We don’t really know how cryptocurrency will end but we do know what Benjamin Graham taught and that was to not speculate. Instead remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

Our business is based on referrals, so if you have family, friends or colleagues that want advice please ask them to contact us.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.