30 Nov 2023

Berkshire Hathaway: Talent

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Berkshire Hathaway Inc. (Berkshire) is a publicly listed American multinational conglomerate headquartered in Omaha, Nebraska which was run by Warren Buffett and Charlie Munger.

Charlie Munger has passed away age 99.

Berkshire is effectively a LIC (Listed Investment Company) or more simply a professionally managed fund. Its business is the business of investing in other businesses.

Now with Charlie Munger gone, will Warren Buffett retire?

Unlikely but Buffett and Berkshire have lost an incredible talent.

Talent, specifically having the right Portfolio Manager working for you is the key to achieving above index performance.

Vale Charles Munger (1924 – 2023).

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

23 Nov 2023

Market Metrics: Profitable vs Unprofitable

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Benjamin Graham is just such a talent, even in death he is always right.

Graham laid the foundations for value investing principles which detail how to value an asset.

Many ‘things’ can be called an asset but Graham narrows down the investable universe of ‘things’ using key criteria, the most important of which is that the ‘thing’ you buy must produce a profit.

It is incredibly easy to get attracted to shiny and exciting ‘things’ on the promise that they will make a profit but time and time again it proves to be a financial disaster.

To give you an example of Graham’s thinking we have attached charts that track profitable and unprofitable ‘things’ and unsurprisingly, decade after decade the investors chasing the unprofitable shiny and exciting ‘things’ suffer financially.

Click for chart.

Newealth is built on Graham’s principles, boring yes but beautiful in how they just work.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

14 Nov 2023

US Recession???

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We have been asking why the United States has still not gone into a recession given that the Effective Federal Funds Rate has increased from 0.08% in December 2021 to the current 5.33% that was reached in September 2023.

The answer is the US consumer.

Inflation has fallen while wages have risen and there is much more excess savings (US$816 billion remaining) than what was previously estimated.

Click for chart.

This implies that GDP (Gross Domestic Product) in the United States will continue to be positive for the next 12 months.

We will wait and then react because when recessions do occur, they always present investors with an opportunity to buy more quality assets at a discounted price.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

8 Nov 2023

Recession Probability Indicator

- Posted by Dejan Pekic BCom DipFP CFP GAICD

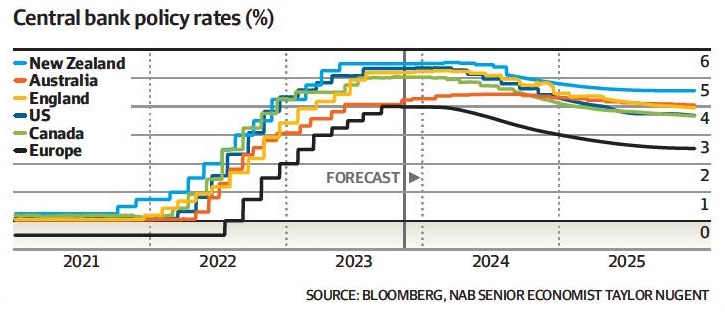

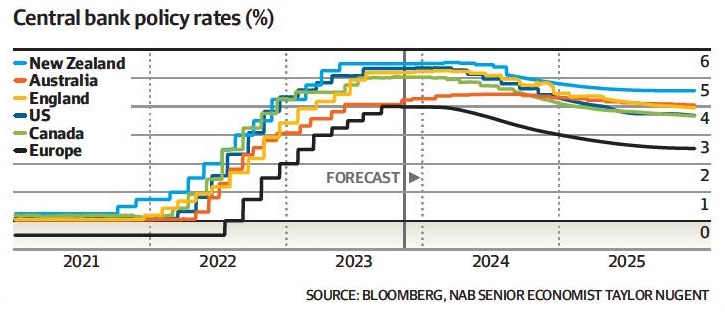

The RBA (Reserve Bank of Australia) increased interest rates yesterday by 0.25% to bring the official Cash Rate up to 4.35% in order to reduce inflation.

The interest rate chart above points to a peaking in central bank interest rates except for Australia which is expected to go higher again in 2024.

Will this new interest rate increase tip us into a recession?

The answer is that we cannot be certain.

The attached chart is the latest Worldwide Recession Probability indicator and it puts Australia right on the fence at 50% likely.

Click for chart.

The key to remember is that even when Australia’s does go into the next recession, it will present investors with an opportunity to buy more quality asset at a discounted price.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.