25 Sep 2023

Market Metrics: EPS

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The numbers keep supporting a slow down for the Australian economy.

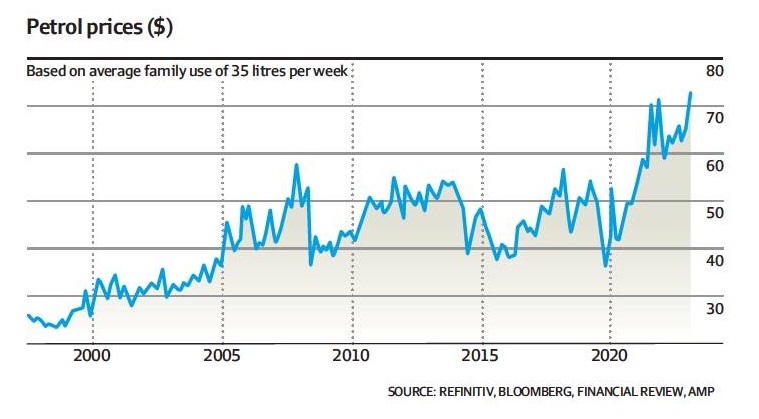

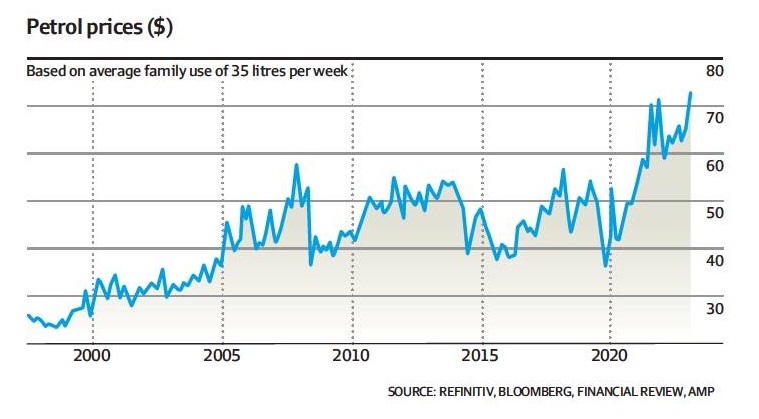

The chart above tracks the weekly cost of filling up a vehicle which is at record levels which negatively impacts on surplus disposable income for other spending.

For business it is all about EPS (earnings per share) growth which is a measure of a company’s profitability and calculated by dividing a company’s net income by its number of shares outstanding.

We want EPS to grow.

However with consumers spending less widely, EPS growth is forecast to slow into 2024.

Click for chart.

As Benjamin Graham taught, there is nothing that we can do about economic cycles which is why remaining invested according to your appetite for volatility is key and when panic takes hold, react by buying more quality assets at discounted prices.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

22 Sep 2023

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

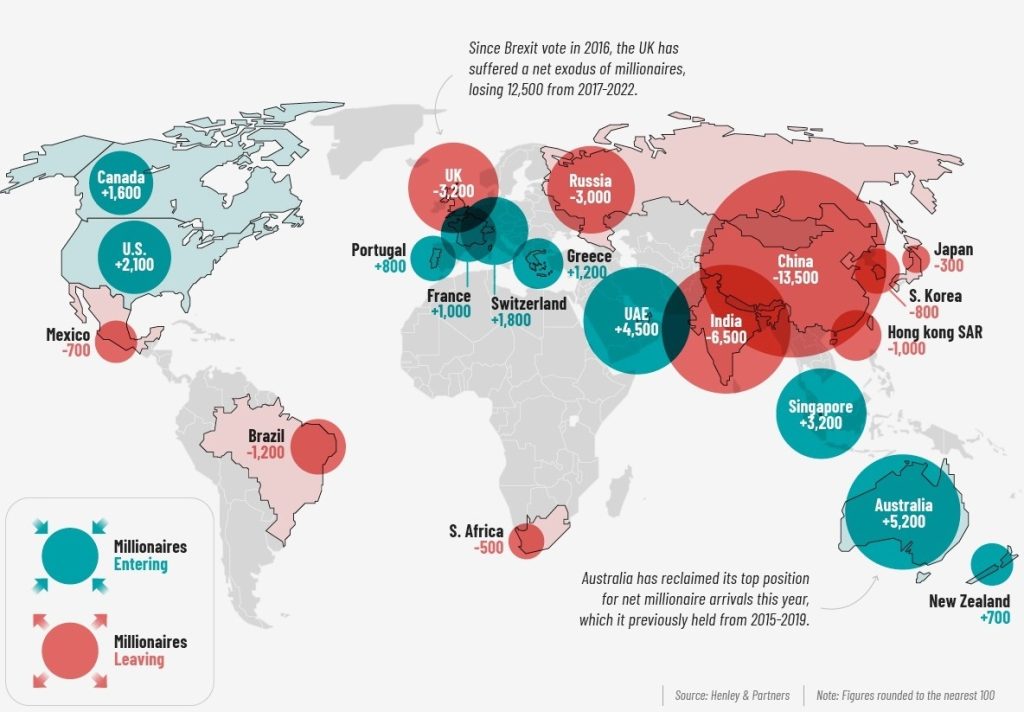

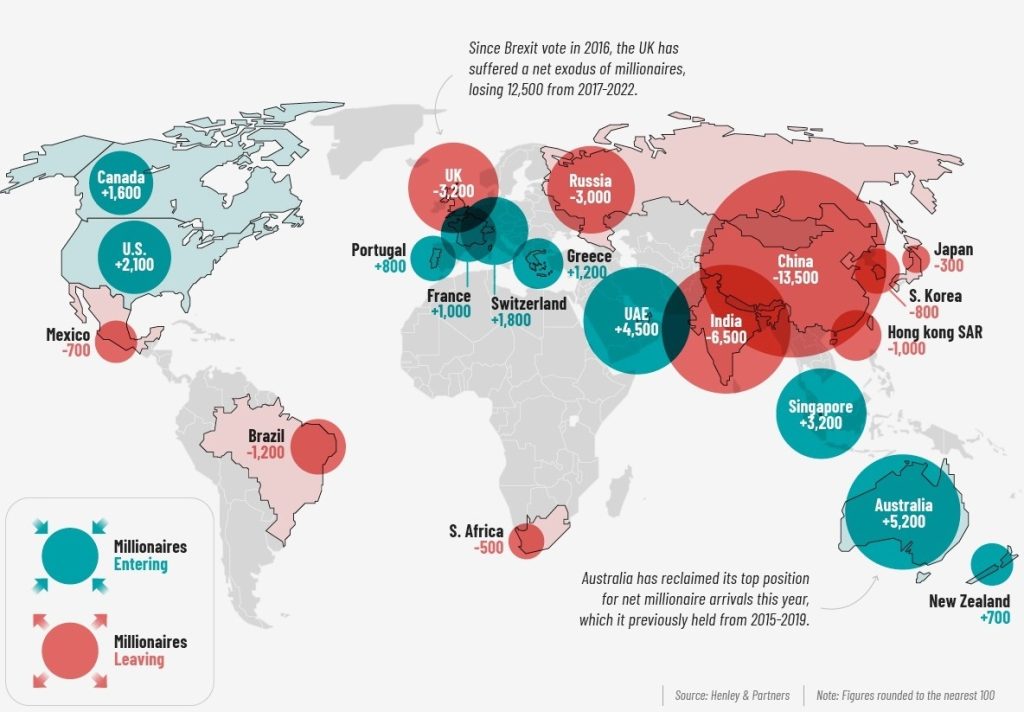

If you are still unconvinced that immigration is not the immediate pain point for the lack of affordable residential property in Australia then let us take a look at millionaire migration.

The High Net Worth (HNW) are defined as individuals having wealth over US$1,000,000 which is AU$1,560,000.

According to Henley & Partners the number one destination for HNW is Australia with 5,200 migrating this year followed by United Arab Emirates who are attracting 4,500 and Singapore bringing in 3,200.

These HNW are leaving China, India, Russia and United Kingdom which is no surprise apart from India who’s economy is very good, growing at 7.8% in the April to June 2023 quarter.

If the Federal Government wants to stop steep rises in residential property prices and steep rises in rents then it needs to either cut immigration immediately or streamline the building of more residential property.

Building more residential property is preferable because it brings economic benefits but it takes years to deliver on the supply of residential property which is needed today.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

21 Sep 2023

Australian Residential Property: Surging population

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Immigration without doubt is the immediate pain point for the lack of affordable residential property.

We simply do not build enough residential property for the additional people that come to work and live in Australia.

Our population rose by 563,000 for the 12 months to 31 March 2023 with 454,000 being new migrants moving to Australia.

That is a lot of people/families needing shelter to live.

Click for charts.

Immigration will continues to fuel steep rises in residential property prices and steep rises in rents which is not sustainable.

The answer is to either cut immigration which can be done immediately or build more residential property.

The challenge with building more residential property is that it takes years to complete.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

14 Sep 2023

Megatrends

- Posted by Dejan Pekic BCom DipFP CFP GAICD

All the numbers keep pointing to a recession in the United States in 2024 which on the basis of probability is more likely than not to occur.

However this is still not going to stop ‘software consuming the World’ over the next few decades or population growth or energy transition.

For outline of these three megatrends.

Click for charts.

Yes population collapse is still expected but only after population peak.

If you have family, friends or colleagues that want to take advantage of megatrends such as this, please ask them to contact us and we will work out how best to help.

8 Sep 2023

US Recession???

- Posted by Dejan Pekic BCom DipFP CFP GAICD

It has now been 12 months exactly since we flagged that the research pointed to a recession in the United States in 2023.

Officially it has not happened but the research and indicators still continue to point to a recession in the United States.

Click for US Recession Risk Indicators.

When exactly? We do not know.

So why has it not happened already? Because employment has not collapsed.

The research also implies that we are in year 13 of a 20 year bull market based on historic trends which is more likely to be right than wrong because ‘software is consuming the World’.

AI (Artificial Intelligence) is at an ‘inflection point’ for advertising, e-commerce, travel, shared economy and public cloud with the future impact being materially underestimated.

Click for New Secular Bull Market.

The severity and length of this next recession in the United States is not known but it will definitely negatively impact asset prices when it does hit.

The key to remember is that even when the United States and or Australia do go into recession, it will present investors with an opportunity to buy more quality asset at a discounted price.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

1 Sep 2023

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Don’t understand.

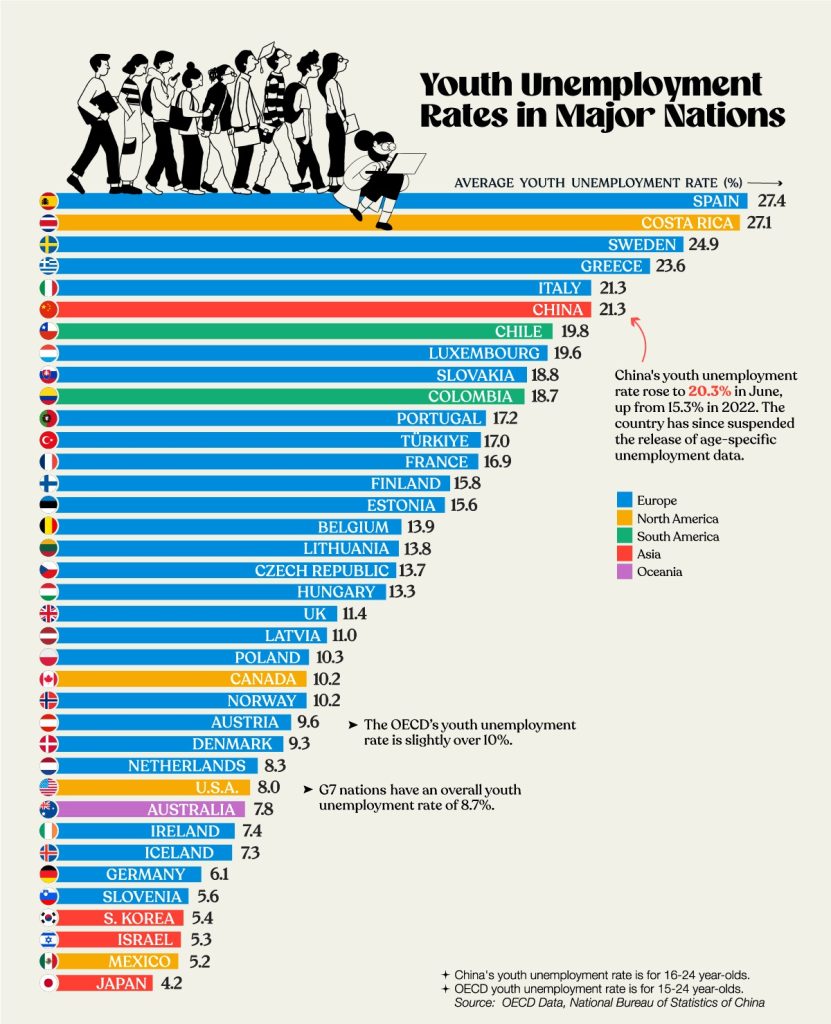

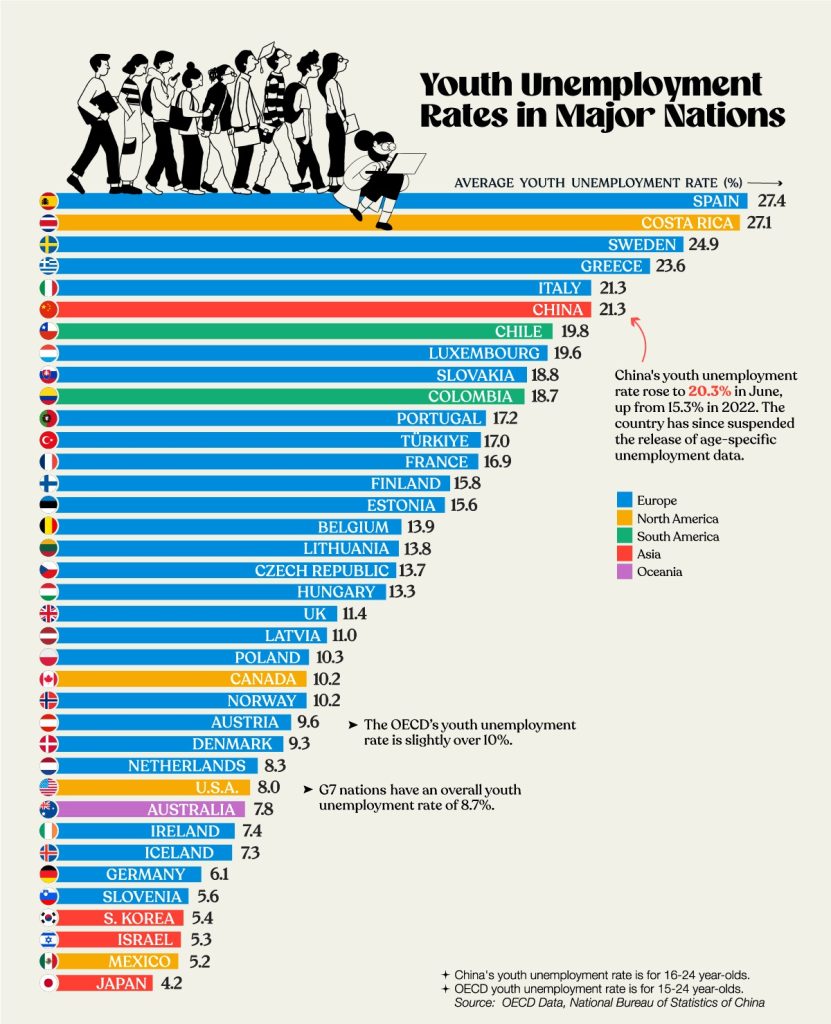

According to the ABS (Australian Bureau of Statistics) the unemployment rate as at July 2023 stands at 3.6% or 528,800 unemployed people.

The reason we do not understand what is going on with unemployment is because youth unemployment for 15 to 24 year olds is running at 7.8% which is double the total rate and businesses keep announcing that they can’t find people to work.

Why?

The Federal Government has responded by migrating 195,000 people into Australia during the 30 June 2023 financial year and adding a further 190,000 during the current 30 June 2024 financial year.

The total over the three years to 2025 is expected to be circa 600,000 people which is a lot of new people.

The good news is that Australia’s youth are not suffering through the employment disaster currently befalling Spain which stands at 27.4% unemployment.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.