9 Aug 2023

Cost of Living in Retirement: How much do I need?

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

According to the ASFA Retirement Standard, a ‘comfortable lifestyle’ in retirement is one that allows for a broad range of leisure and recreational activities and to have a good standard of living through the purchase of things such as household goods, private health insurance, a reasonable car, good clothes, a range of electronic equipment and domestic plus occasionally international holiday travel.

This means that today you need $70,482 per annum (March quarter 2023) to achieve a ‘comfortable lifestyle’ in retirement if you are a 65 to 84 year old retired couple who owns their own home (Link).

The income you need reduces to $50,004 for a single.

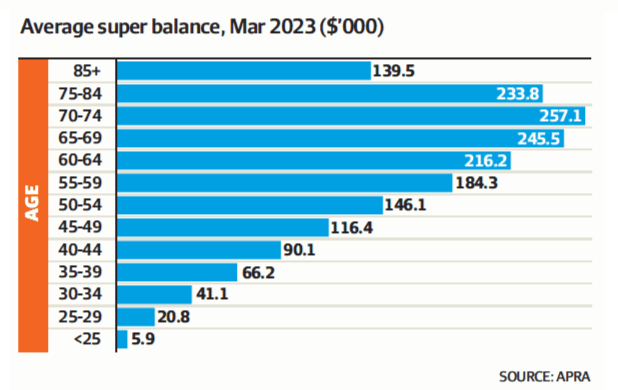

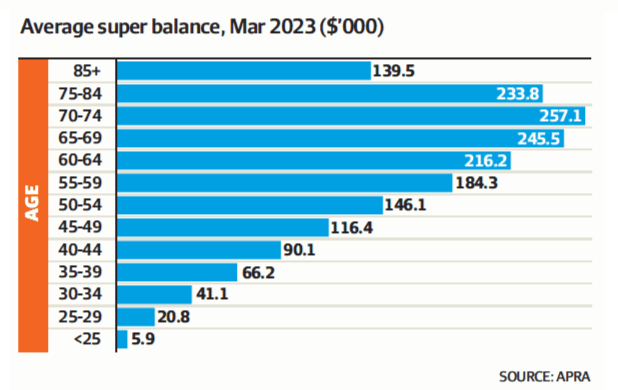

The challenge however is that according to APRA (Australian Prudential Regulatory Authority), the average superannuation balance is $245,500 for ages 65 to 69 which would require a couple to draw at 14.4% to receive $70,482 per annum from a combined $491,000 superannuation balance.

Good luck if you think it is achievable to earn 14.4% per annum plus inflation over the next four decades and retain capital without taking enormous volatility risk.

It is not all bad news because a ‘comfortable lifestyle’ can be achieved, it just needs you to start planning early.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.