31 Aug 2023

Future Fund

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Future Fund was established in 2006 to limit the taxation burden on Australian tax payers in meeting the escalating future superannuation liabilities of the Commonwealth Public Service.

The Future Fund delivered a 6.0% return for the 12 months to 30 June 2023 which was below its target benchmark given its 60% allocation to growth assets and 40% defensive assets.

Click to read.

What you may not know about the Future Fund is that its investment methodology follows Benjamin Graham thinking in that the vast majority of people are not capable of making investment decisions.

This is why the Future Fund hires some of the very best talent (Portfolio Managers) that money can buy to manage its assets.

Smart.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

25 Aug 2023

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

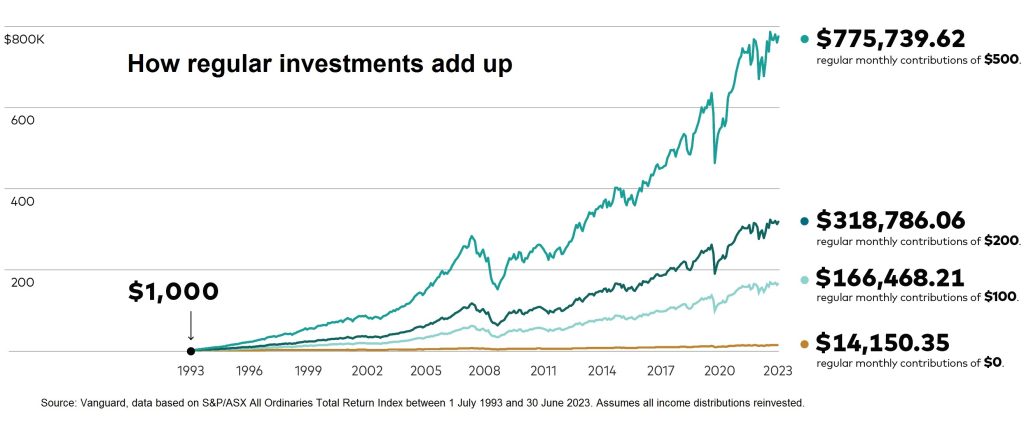

According to Albert Einstein…

“Compound interest is the eighth wonder of the world.

He who understands it, earns it… he who doesn’t, pays it.”

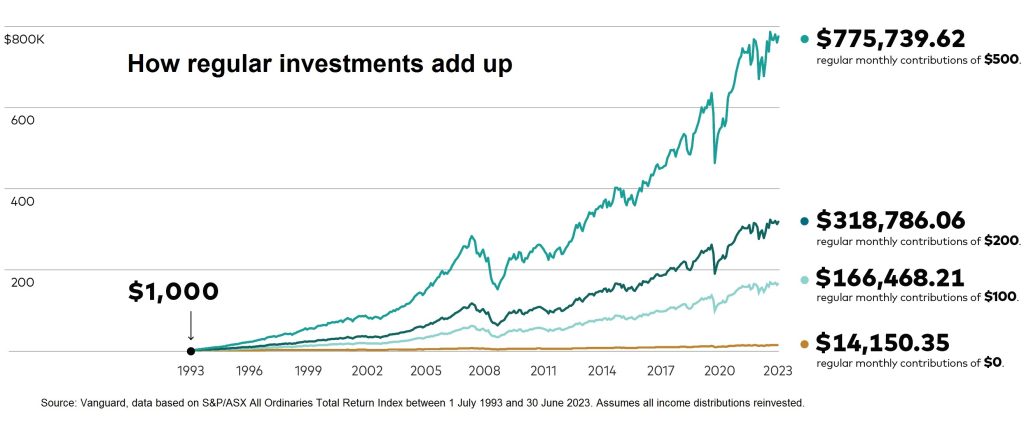

If you invest $1,000 in Australian listed companies on 1 July 1993 then 30 years later you will have 14 times that amount or $14,150 which is a excellent result.

However, if you invested that same $1,000 and added $100 per month for 30 years then you will have 11.8 times more than $14,150 or $166,468.

Compounding is truly the secret ingredient for wealth accumulation but it’s not a secret.

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances please do not hesitate to contact us directly.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

24 Aug 2023

2023 Intergenerational Report: Old-age dependency ratio

- Posted by Dejan Pekic BCom DipFP CFP GAICD

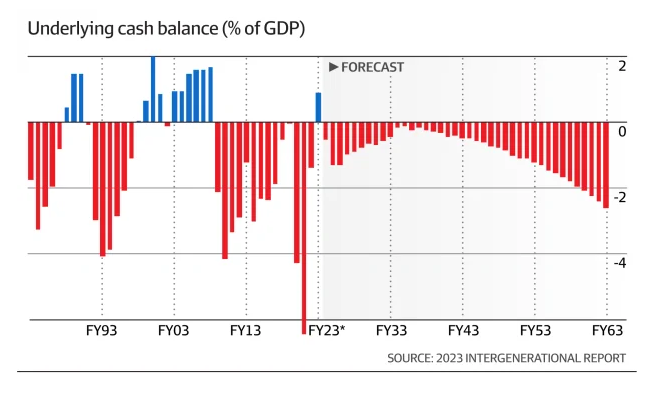

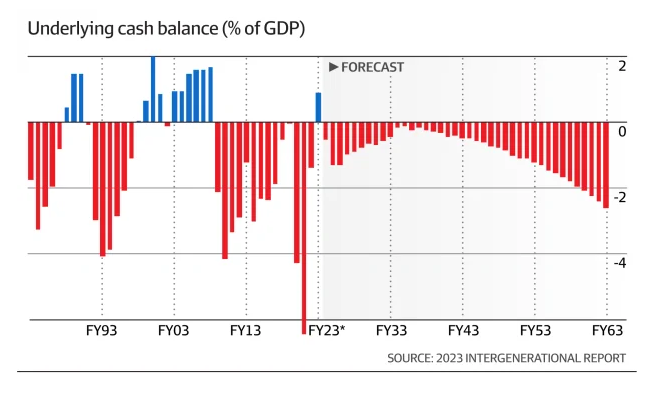

The 2023 Intergenerational Report forecasts an outlook for the Australian economy and the Federal Government’s budget over the next 40 years.

The forecast is for the population to reach 40.5 million by 2062-63 with the number of people aged over 65 doubling and the number aged over 85 tripling.

The old-age dependency ratio which is the ratio of working-age people to those over 65 will increase plus cost NDIS is expected to keep the Federal Government budget in deficit for the next 40 years.

Click to read.

What will be the Federal Government solution? Increase tax revenue.

This is why planning is so important.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

17 Aug 2023

US Interest Rates: How much higher can rates go?

- Posted by Dejan Pekic BCom DipFP CFP GAICD

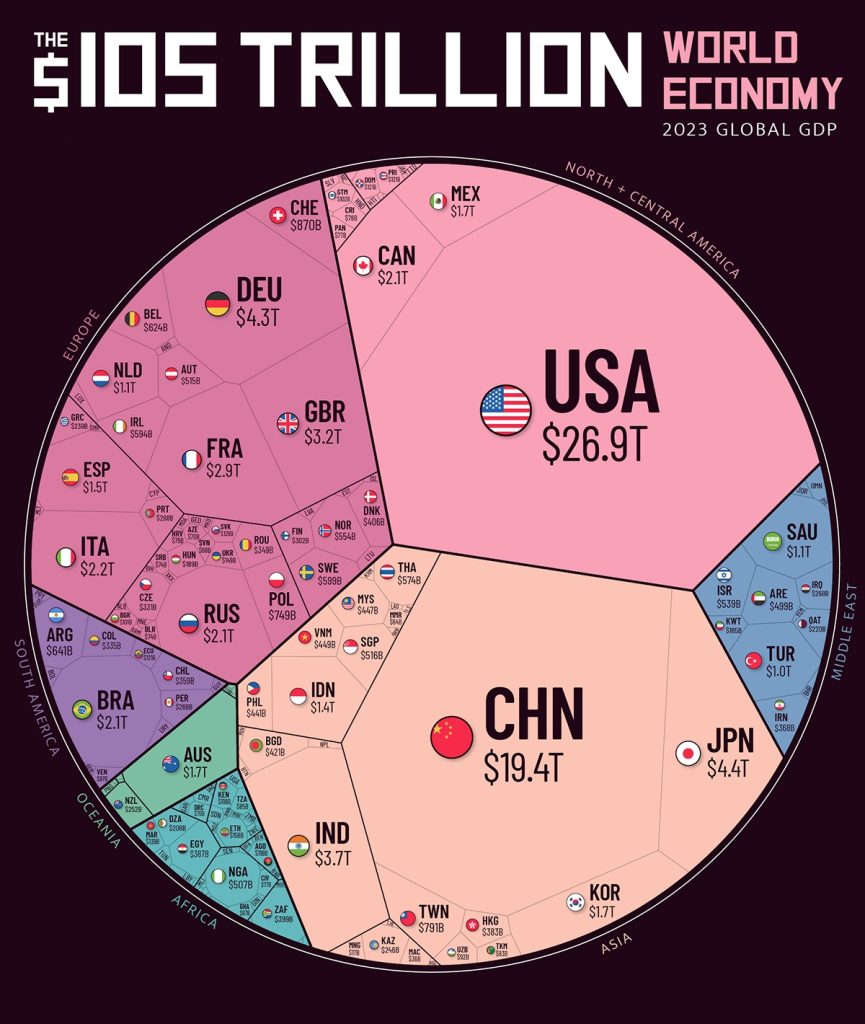

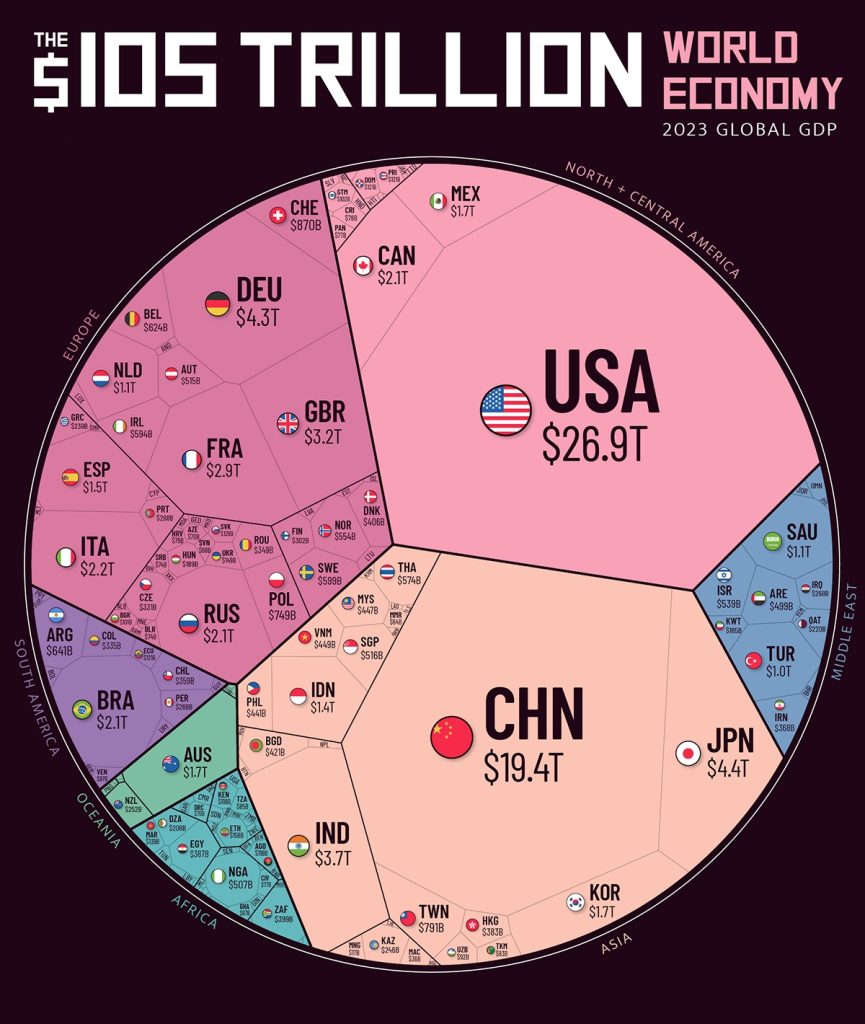

The World GDP (Gross Domestic Product) now exceeds US$105 trillion is the United States is still number one at US$26.9 trillion with China a distant second at US$19.4 trillion.

This is why the United States remains the reserve currency.

The US 10 year bond yield has moved up from 0.54% in March 2020 to 4.28% today however it remains difficult to see US 10 year bond yield rising back to pre-GFC (Global Financial Crisis) levels of 6.00% to 8.00%.

Why, because of the size of US debt which is approaching US$33 trillion and acts as a go slow on ising interest rates.

Click for chart.

Put simply, the United States is awash with debt and to rapidly take the US 10 year bond yield back to 6.00% to 8.00% would collapse asset prices.

As Benjamin Graham taught, remain invested according to your appetite for volatility and if bond yields pushing upwards cause fear and panic to take hold, then react by buying more quality assets at discounted prices.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

10 Aug 2023

The Age of AI has begun: A defining moment

- Posted by Dejan Pekic BCom DipFP CFP GAICD

If you look back over the last couple of decades something happened that changed everything.

Apple released the first iPhone on the 29 June 2007 with a true graphical interface and Apps that has changed everything.

The rest is history with mobile Apps bring business and customers together using one single device and as a consequence, billions/trillions of dollars in sales revenue.

Well we are there again, it was when OpenAI released ChatGPT on 30 November 2022 and this LLM (large language model) which marks the start of the 4th era in computing, Artificial Intelligence.

Artificial Intelligence is ‘software consuming the World’ and this decade is when everything changes for all of us and this is the place to invest.

It is a certainty that these LLM’s will bring business and customers together in new ways to this time create trillions of dollars in sales revenue.

Click for chart.

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances please do not hesitate to contact us directly.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

9 Aug 2023

Cost of Living in Retirement: How much do I need?

- Posted by Dejan Pekic BCom DipFP CFP GAICD

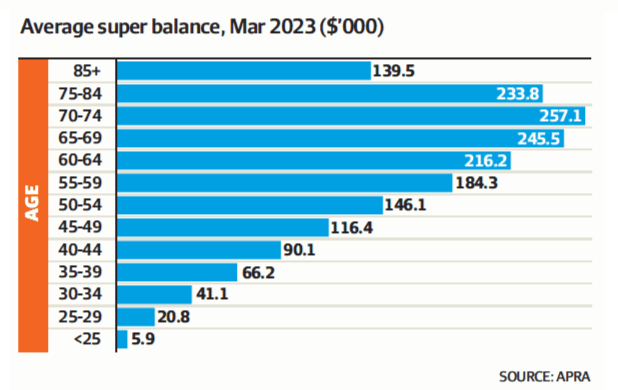

According to the ASFA Retirement Standard, a ‘comfortable lifestyle’ in retirement is one that allows for a broad range of leisure and recreational activities and to have a good standard of living through the purchase of things such as household goods, private health insurance, a reasonable car, good clothes, a range of electronic equipment and domestic plus occasionally international holiday travel.

This means that today you need $70,482 per annum (March quarter 2023) to achieve a ‘comfortable lifestyle’ in retirement if you are a 65 to 84 year old retired couple who owns their own home (Link).

The income you need reduces to $50,004 for a single.

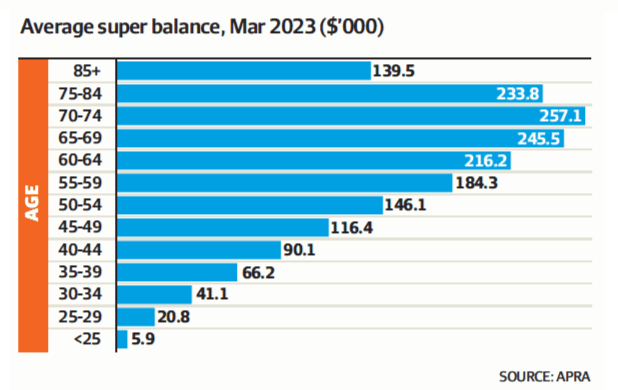

The challenge however is that according to APRA (Australian Prudential Regulatory Authority), the average superannuation balance is $245,500 for ages 65 to 69 which would require a couple to draw at 14.4% to receive $70,482 per annum from a combined $491,000 superannuation balance.

Good luck if you think it is achievable to earn 14.4% per annum plus inflation over the next four decades and retain capital without taking enormous volatility risk.

It is not all bad news because a ‘comfortable lifestyle’ can be achieved, it just needs you to start planning early.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.