31 May 2023

Australian Residential Property Solution

- Posted by Dejan Pekic BCom DipFP CFP GAICD

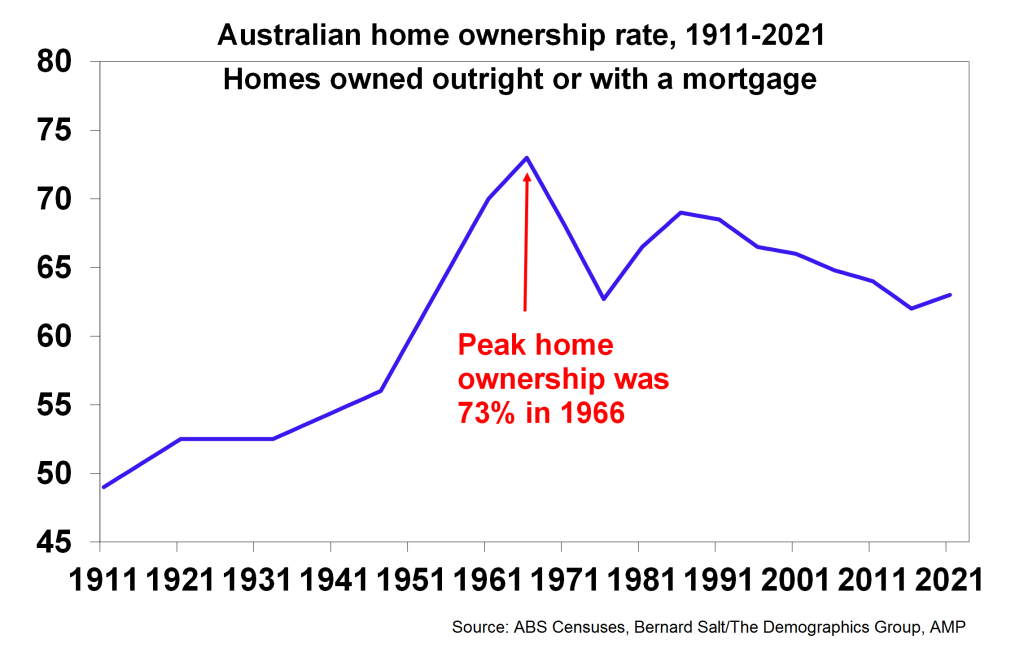

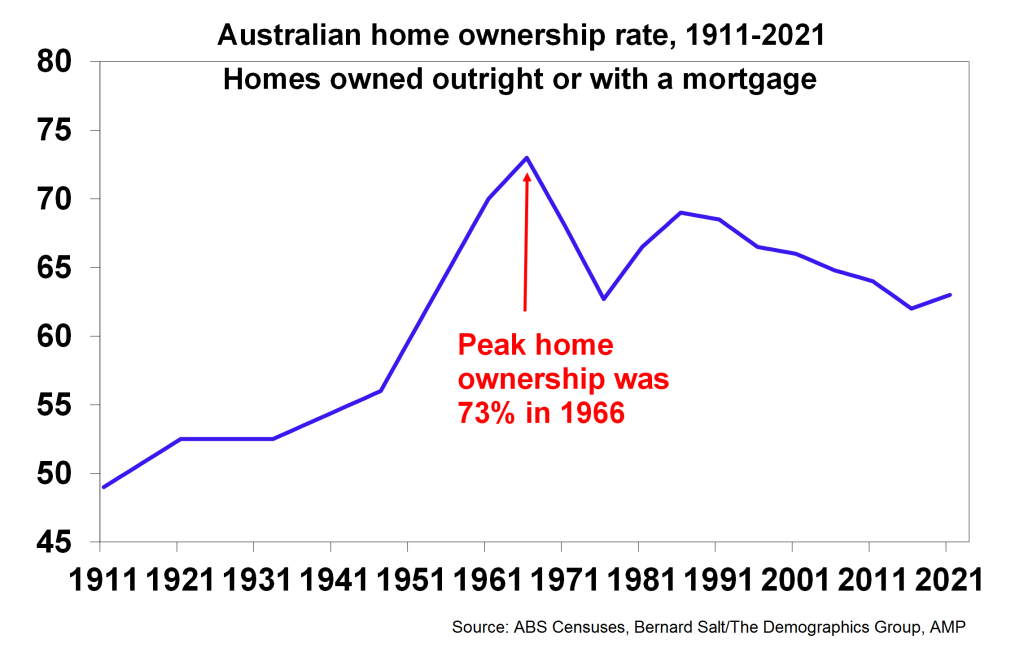

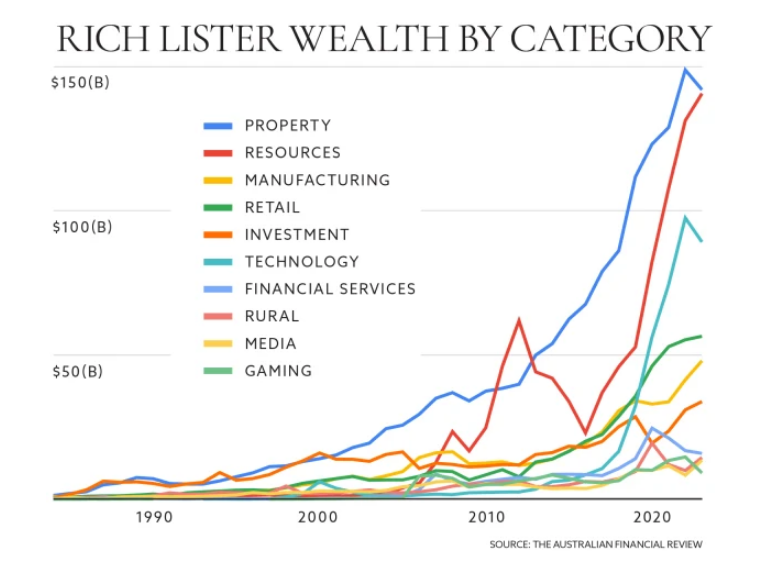

Home ownership in Australia peaked in 1966 at 73% of the adult population while today it sits at 63% and is likely to fall further.

The problem is lack of supply of residential property.

The Federal Government is planning to bring up to 700,000 migrants into Australia over the next 24 months and these people need to sleep somewhere.

NIMBY (not in my backyard) resistance from residence and local councils is acting as a further break on building new residential property.

The result is high residential property prices and increasing rents.

The solution is simple, build more residential property by learning from our neighbours across the ditch.

Click to read.

Steep rises in residential property prices and steep rises in rents is not sustainable.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

26 May 2023

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

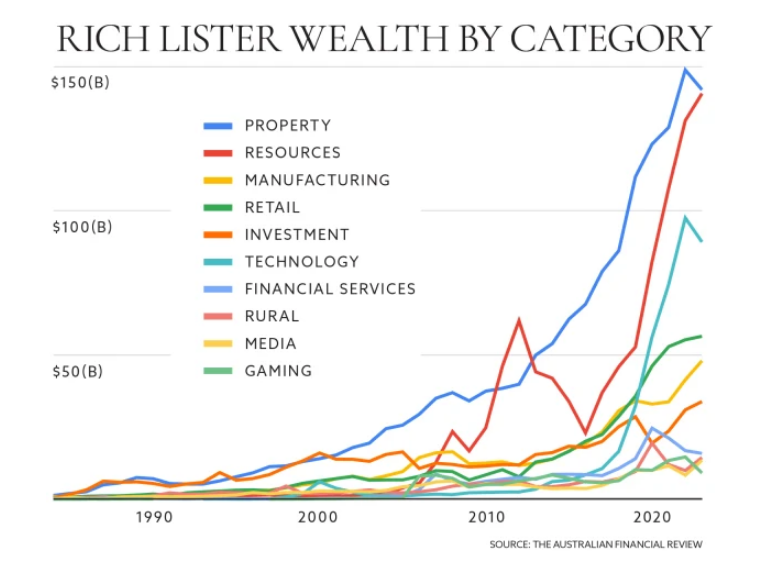

The 2023 Rich List is out today and again Gina Rinehart tops the list with $37.41 billion.

2022 was a dreadful year for asset prices but still Australia’s richest people 200 managed to increase their wealth by 1%.

And where did this wealth come from?

The majority came from the business of building property and the business of mining.

Click for Rich List.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

16 May 2023

US Inflation Expectations

- Posted by Dejan Pekic BCom DipFP CFP GAICD

COVID-19, printing money and the Ukraine invasion have all worked together to drive inflation up but raising interest rates appears to have brought rising inflation to an end.

Click for chart.

Meaning that the fall in asset prices presents investors with an opportunity to buy more quality asset at a discounted prices.

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances please do not hesitate to contact us directly.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

12 May 2023

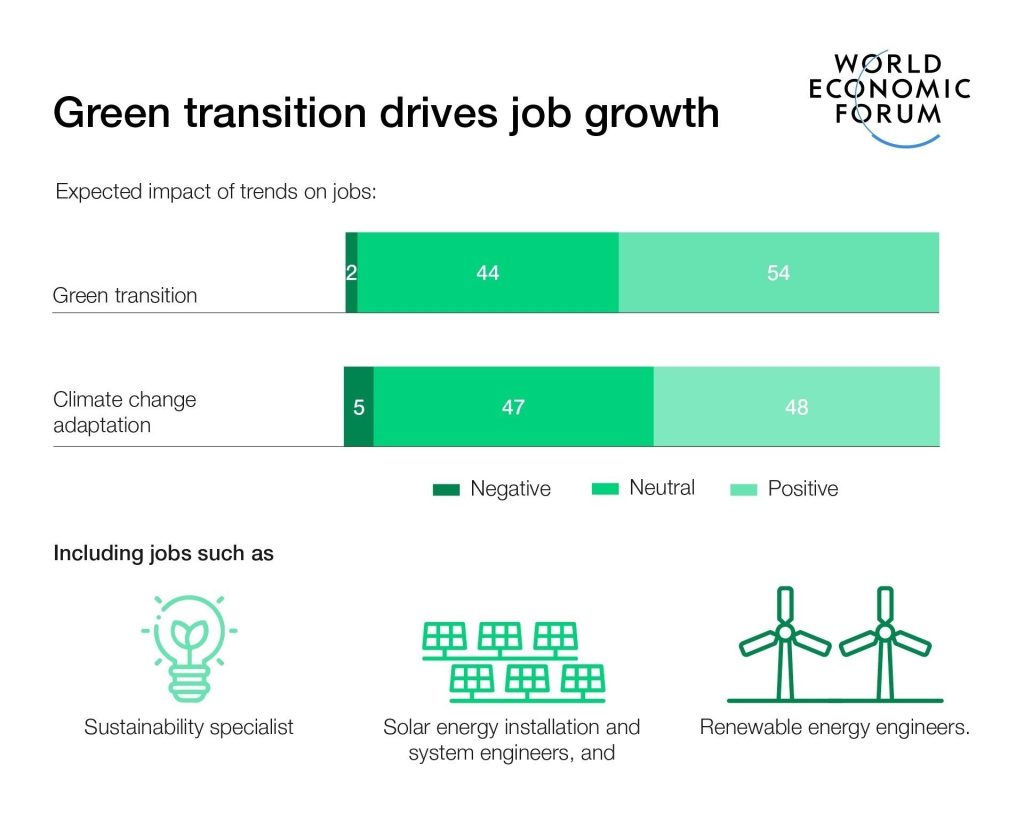

World Economic Forum: Human Jobs

- Posted by Dejan Pekic BCom DipFP CFP GAICD

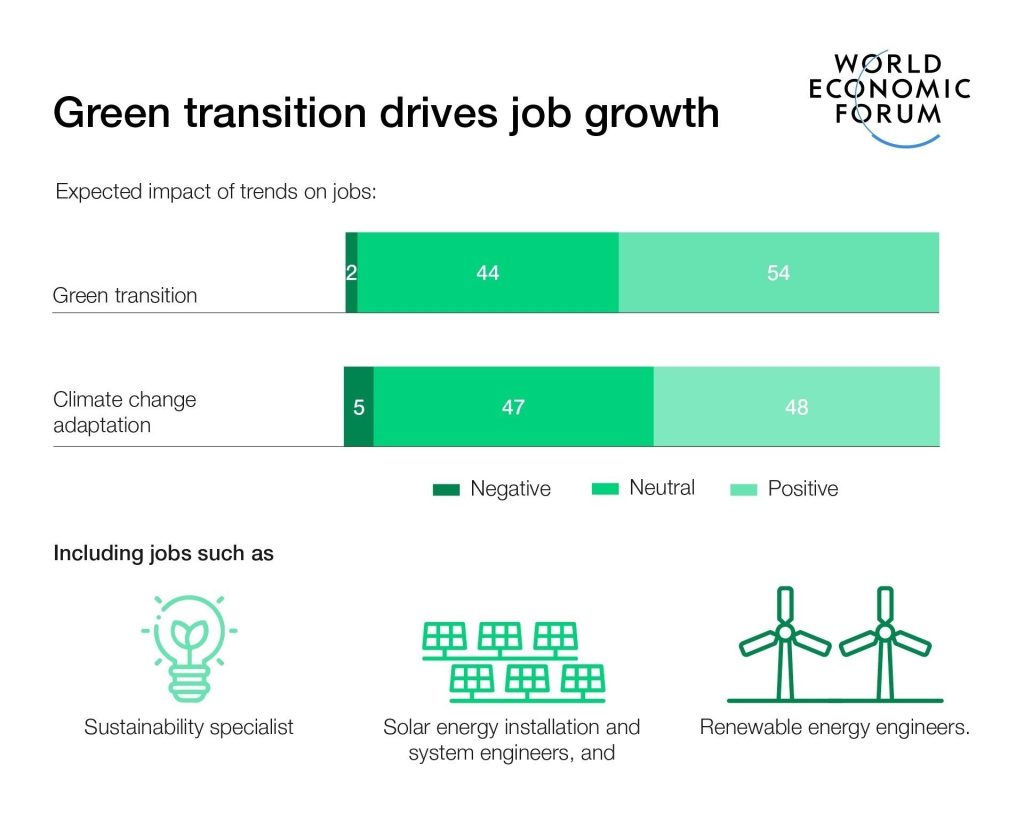

The World Economic Forum has just published the 2023 Future of Jobs detailing the fastest growing and fastest declining jobs.

Smart technologies (artificial intelligence) is making bank tellers, cashiers and data entry clerk obsolete while autonomous/electric vehicle specialists are the fastest growing jobs in 2023.

The ‘digital revolution’ and ‘going green’ is reshaping jobs globally.

‘Software is consuming the World’ and this decade is when everything changes for all of us.

Click to read.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

10 May 2023

Australian Federal Budget 2023

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Federal Treasurer Jim Chalmers has handed down his second Budget with a lucky return to surplus or was it just that we are being excessively taxed?

A few of key opportunities include-

- Energy Price Relief Plan

- Pay increases for aged care workers and more home care packages

- Small business $20,000 instant asset write-off

- Aligning employer Superannuation Guarantee payments with payday

- New 15% tax increase for super balances over $3 million

It is important to remember that these Budget announcements are currently proposals and will still need to be legislated.

Click to read.

4 May 2023

Up to a 50% guaranteed return: Superannuation Co-contribution for 30 June 2023

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Federal Government Co-contribution was introduced from 1 July 2003 as an initiative to encourage low to middle income earners to save for their retirement within superannuation.

If you make a contribution of up to $1,000 into your superannuation account before 30 June 2023, the Federal Government will add an additional sum provided that you are earning less than $57,016 this financial year.

The table below shows you how much the Federal Government will contribute for various amounts.

|

If your total

annual

income is:

|

…and you make

personal contributions of:

|

…then the maximum Government

co-contribution is:

|

|

$42,016 or less

|

$1,000 |

$500 |

|

$45,016

|

$800 |

$400 |

|

$48,016

|

$600 |

$300 |

| $51,016 |

$400 |

$200

|

| $54,016 |

$200 |

$100

|

| $57,016 or more |

$0 |

$0

|

WARNING, this does not constitute Personal Advice. To discuss if this is an appropriate strategy for your given circumstances please do not hesitate to contact us directly.

Yes, there are always additional eligibility conditions and if you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

2 May 2023

Deal maker or opportunist: First Republic Bank

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Jamie Dimon CEO JPMorgan Chase has done it again.

US financial authorities have sold California’s First Republic Bank to JPMorgan Chase.

First Republic Bank was valued at US$40 billion in November 2021 which was just before the Ukraine invasion in February 2022 and last Friday had a valuation of US$654 million which has wiped out the shareholders.

In total, a 98.4% discount for First Republic Bank which was holding US$233 billion in assets as at 31st March 2023.

You would think that this is the deal of the century except that Jamie Dimon has done this before when in 2008 JP Morgan Chase purchased Bear Sterns and Washington Mutual for effectively nothing.

Click to read.

During times like this it is most important to remain invested according to your appetite for volatility and continue to look to buy more quality assets when discounted prices present.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.