14 Sep 2022

Recession Indicator: United States (Part 2)

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

As a follow on to Monday, the reason for asking whether history is repeating or rhyming is because it is impossible to accurately predict the future.

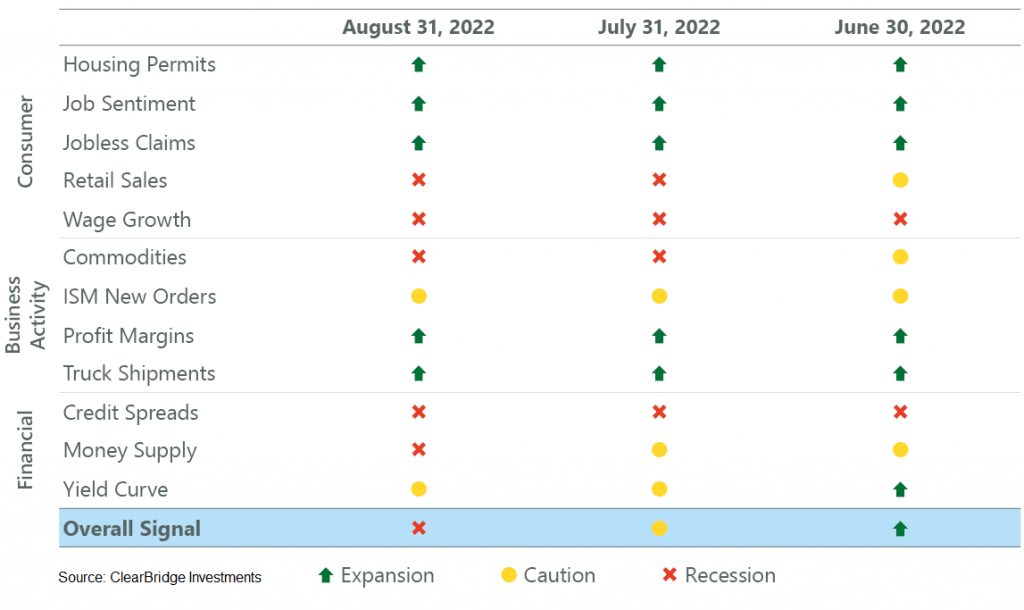

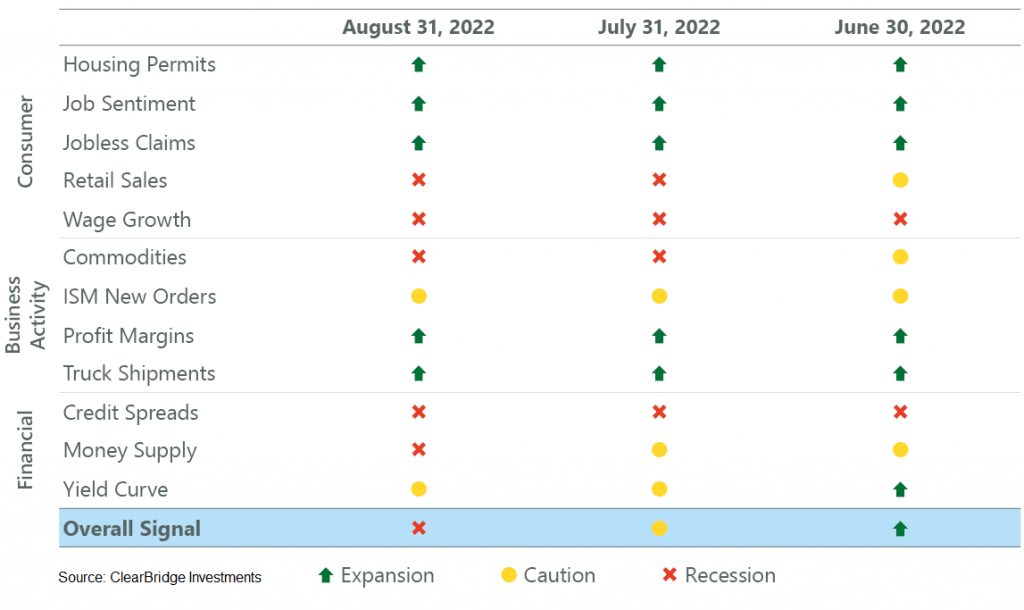

It can be clearly seen from the attached chart that the United States does not go into a recession every time it begins increasing interest rates.

Click for chart.

Jerome Powell, the Chair of Federal Reserve of the United States is increasing interest rates to slow inflation which is being caused by strong job growth, low unemployment and increasing consumer spending.

Remember, if a recession does follow in the United States and or subsequently in Australia then it will become an even better time for investors to buy more quality asset at a discounted price.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.