31 Aug 2022

The Influence Index: Top 100

- Posted by Dejan Pekic BCom DipFP CFP GAICD

You may or may not be aware of the recently published top 100 influential social media creators in Australia.

There individuals are more commonly referred to as influencers.

The index ranks the influencers based on relatability, trustworthiness, expertise, attraction, content prominence and content frequency.

Number one in Australia is Sarah Magusara who has 19.2m followers across TikTok, Instagram and YouTube.

Click for list.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

26 Aug 2022

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Sweden decided to rely on social distancing instead of lockdowns to combat the COVID-19 virus.

Did it work?

You be the judge and tell us if you agree.

Click to read.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

24 Aug 2022

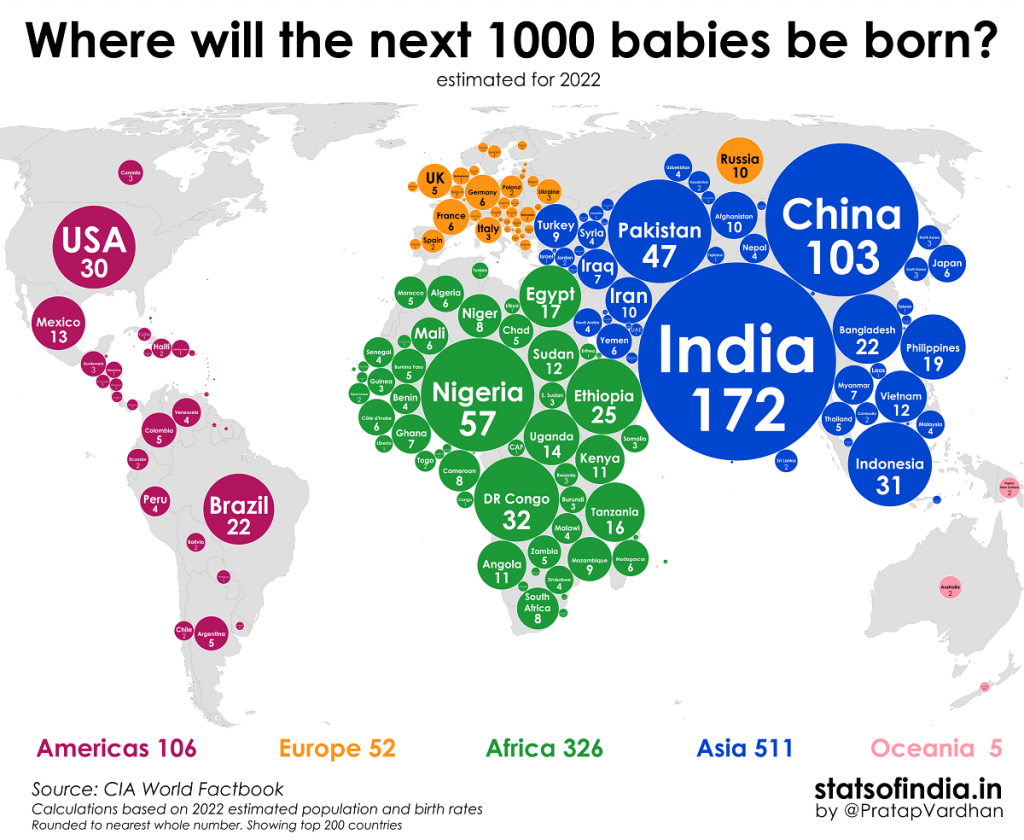

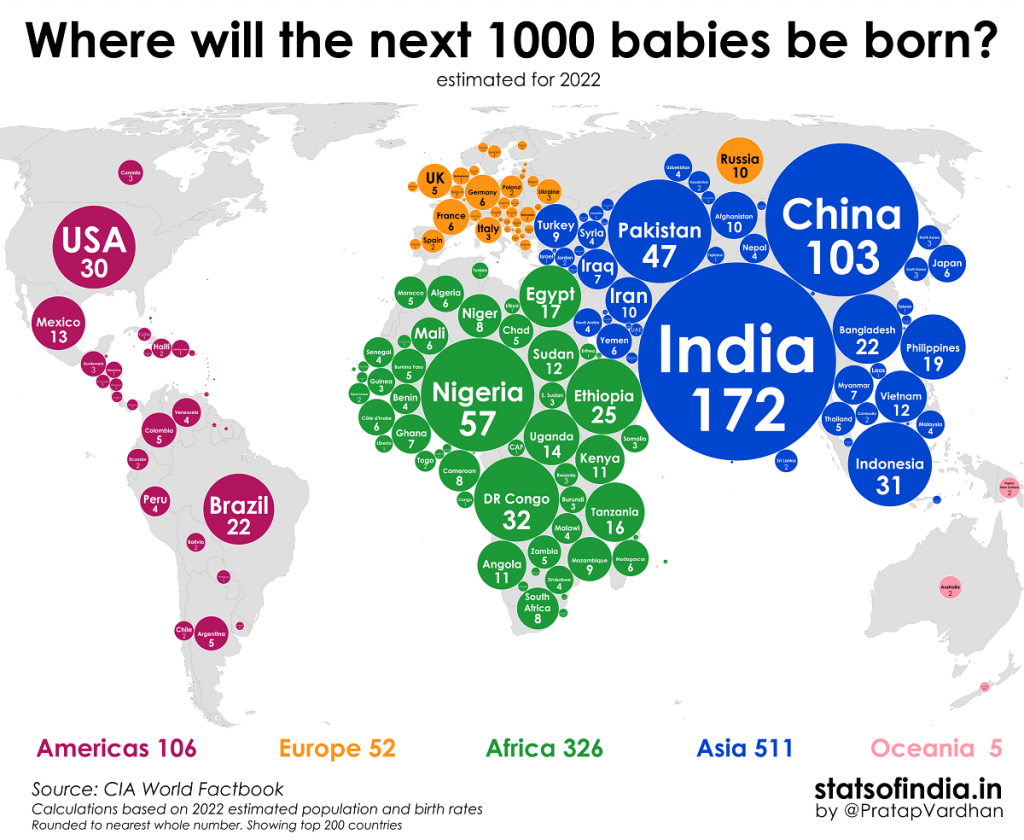

Global Population: The next 1000 babies

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The World population is set to reach 8 billion humans however the fertility rate is collapsing globally as woman do not want to give birth to 8 to 12 babies.

Click for chart.

The likelihood of the global fertility rate reverting back to 8 to 12 babies per woman is very unlikely given that as each nation/society becomes more affluent, people want more choice in living their best life which requires more financially resources and that means less babies.

If we take a closer look at trends, it is the Developed World nations that are at the greatest risk of becoming economically irrelevant over the next 80 years with Asia and Africa combining to deliver 837 of the next 1000 babies to be born.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

19 Aug 2022

Demographics: Baby Boomers

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Grattan Institute has published the following findings on what happens when baby boomers retire.

Their insight is that baby boomers are retiring as the wealthiest generation in human history and baby boomers don’t spend their wealth in retirement.

Their conclusion is that this will lead to baby boomers bequeathing larger inheritances and worsening wealth inequality.

Click to read.

Living ‘more frugally and not spending money’ in retirement is called regret risk.

Many retirees feel a sense of regret in their later years from being overly frugal or conservative in the earlier years of their retirement which was due to managing the conflicting elements of not drawing down too quickly which risks outliving their savings due to increasing longevity.

The solution.

Tell your baby boomers to contact us for financial advice and we will work out how best to help.

18 Aug 2022

Market Metrics: MSCI World EBIT

- Posted by Dejan Pekic BCom DipFP CFP GAICD

EBIT stands for earnings before interest and taxes and is an indicator of a company’s profitability.

By ignoring the tax burden and capital structure, EBIT helps to identify a company’s ability to generate enough earnings to be profitable, pay down debt and fund ongoing operations.

A higher EBIT is much better than a low EBIT.

Global companies operation at a high EBIT has been a contributing factor for why the fall in asset prices paused at correction levels in June and did not crash.

Companies globally are making money even with rising interest rates and inflation.

Click for chart.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

11 Aug 2022

Market Metrics: Private Company Valuations

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We have seen many financial market crashes first hand during the past three decades with the three biggest being the 2000 Tech Wreck (Dot-com Bubble), the 2008 Global Financial Crisis (GFC) and the 2020 Coronavirus Crash.

The period from December 2021 to June 2022 has not been a financial market crash for listed companies in Australian or listed companies globally but the same cannot be said for private companies where Enterprise Valuations have dropped an average of 60%.

That figure is uncomfortabley large.

Click for chart.

The bigger issue however is the lack of liquidity available to investors because there is no public market to buy or sell holdings.

This is our number one concern with unlisted assets because in a crisis you want the flexibility to be able to action changes.

On a more positive note, financial asset prices have increased over the past month because the Mr Market is expecting inflation to slow.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.

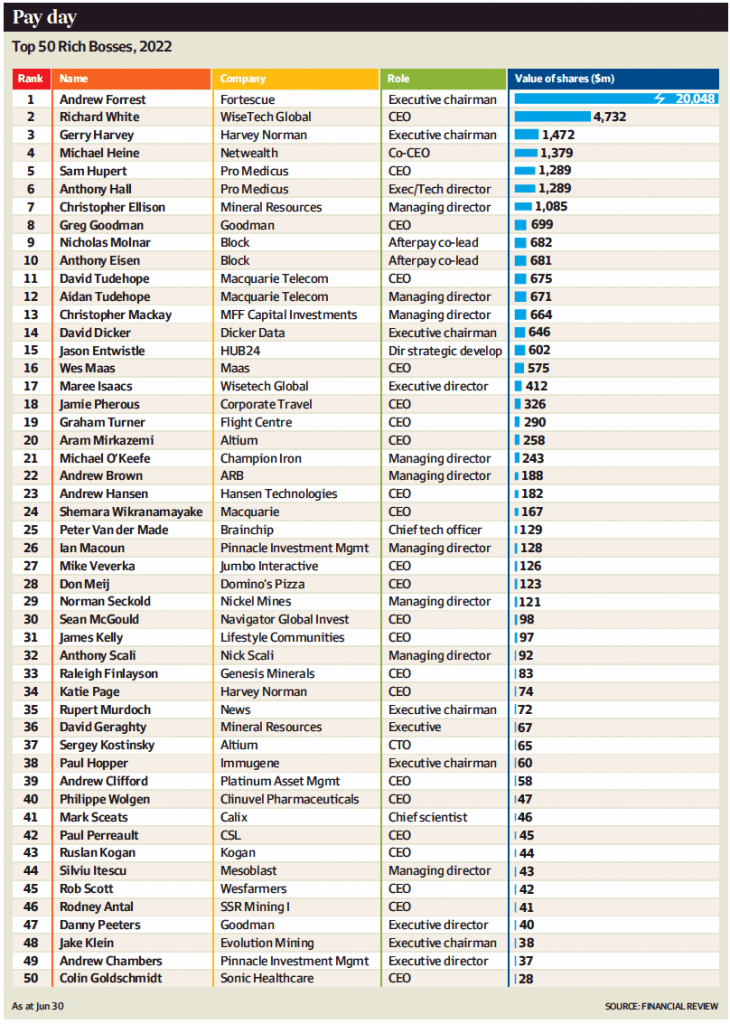

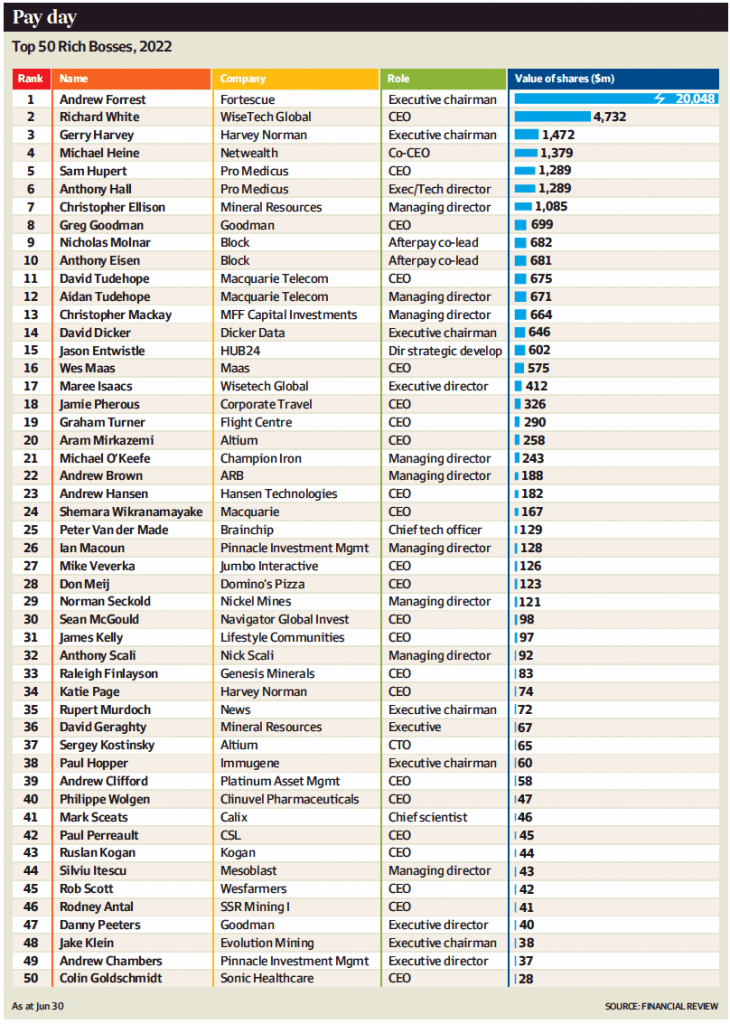

5 Aug 2022

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Does it pay to be the Chief Executive Officer (CEO) of a listed company in Australia?

Absolutely is the answer when the 50th richest boss on the list has a shareholding of $28m in addition to their executive salary and bonus incentives.

Click for table.

3 Aug 2022

Australian Interest Rates

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The RBA (Reserve Bank of Australia) increased the Cash Rate to 1.85% and again the only good news will be for savers.

This is the fourth time in three decades that the RBA has rapidly increased the Cash Rate and every time asset prices have fallen.

Click for chart.

Yes it is likely that RBA will continue to increase Cash Rate with the expectation that residential mortgage interest rates will double from the current medium 3.0% to 6.0% per annum.

More than doubling in residential mortgage interest rates is very unlikely because the Federal Government cannot afford to financially bankrupt residential mortgage holders who account for around 30% of Australian households.

Now is the time to remain invested according to your appetite for volatility and continue to buy more quality assets at discounted prices.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how best to help.