24 Jun 2022

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Just one more reason why it’s smart to invest in technological innovation.

Click this link.

The next 5 to 10 years will see a seismic shift in how humans function as ‘software consumes the World’ through artificial intelligence, battery technology, blockchain, robotics, gene sequencing and electrification.

The Jetson ONE is just one of thousands of technological innovations that are being delivered.

If you have family, friends or colleagues that want financial advice please ask them to contact us and we will work out how to best help them because now is the time.

22 Jun 2022

Warren Buffett, The Oracle of Omaha

- Posted by Dejan Pekic BCom DipFP CFP GAICD

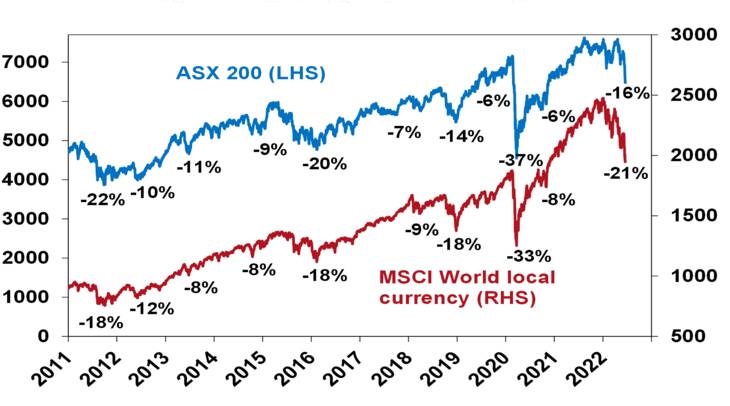

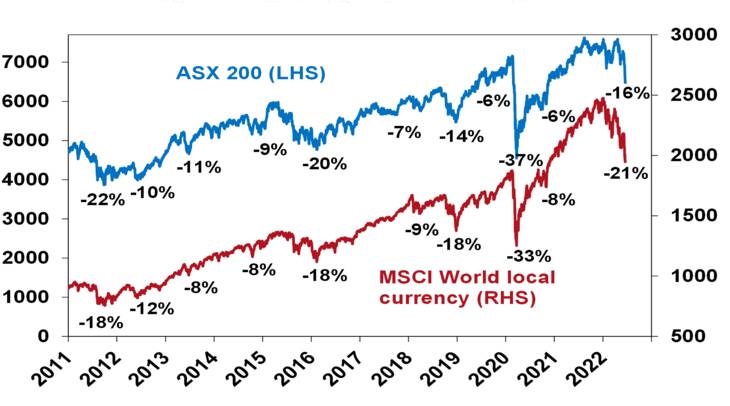

The above chart will help to remind you that asset price corrections and crashes are an irregular occurring certainty.

The chart again confirms that asset price corrections/crashes can just not be avoided.

As we wait to discover whether the current asset price correction has ended or if it will devolve into an asset price crash, best we listen to some choice words of wisdom from Warren Buffett to help calm your nerves.

Click to read.

And if you have family, friends or colleagues that want financial advice, please ask then to contact us and we will work out how to best help them.

17 Jun 2022

Market Metrics: Australian All Ordinaries Index

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Jerome Powell, Chair of Federal Reserve of the United States increased official interest rates by 0.75% this week to aggressively cool a ‘very hot’ American economy.

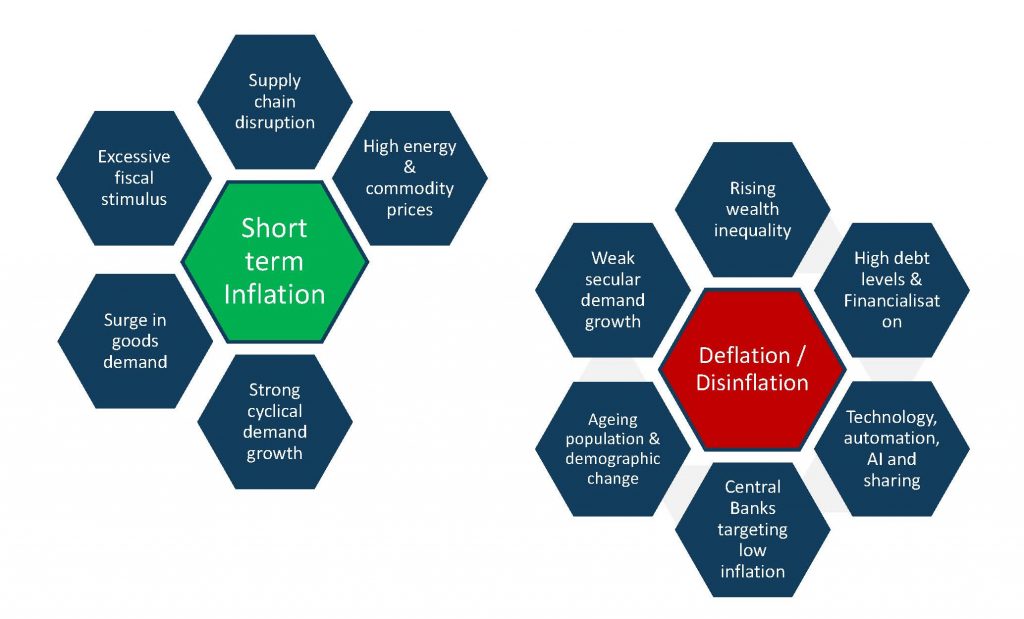

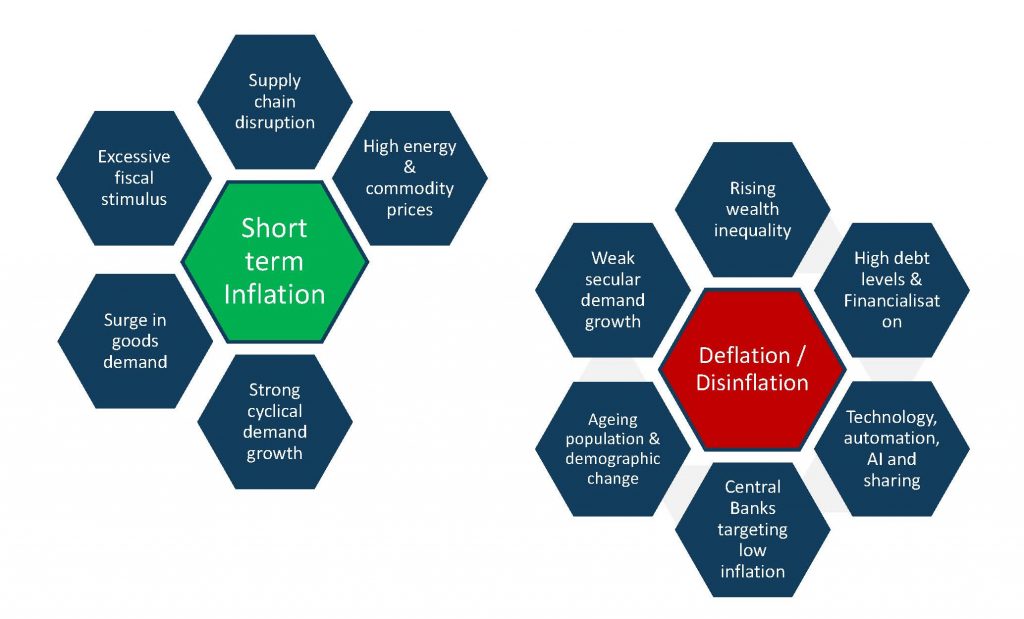

The current short term issue is inflation which is due to supply chain shortages, higher energy/commodity prices and lots of money printing.

However don’t think that the deflation issue has disappeared.

The World still has in excess of US$300 trillion in debt, an aging population and rapid technological automation which sets the World for deflation or low growth over the medium to long term.

If we look back at the Australian All Ordinaries Index over the past 50 years there is a clear message.

No matter the economic challenge, if you do not panic and sell when asset prices have corrected or crashed you are extremely likely to double your investment over any 10 year holding period.

Click for chart.

The current correction in asset prices both in Australian and internationally is sending us a clear message, now is not the time to sell, instead it is the time to remain invested according to your appetite for volatility and continue to buy more quality assets at discounted prices.

10 Jun 2022

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

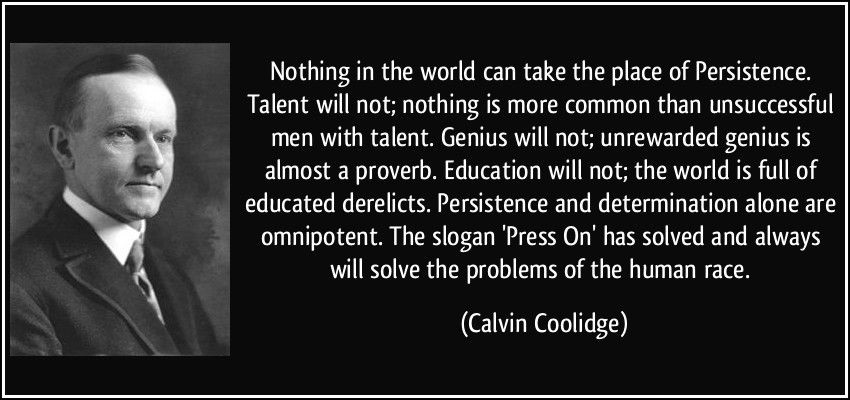

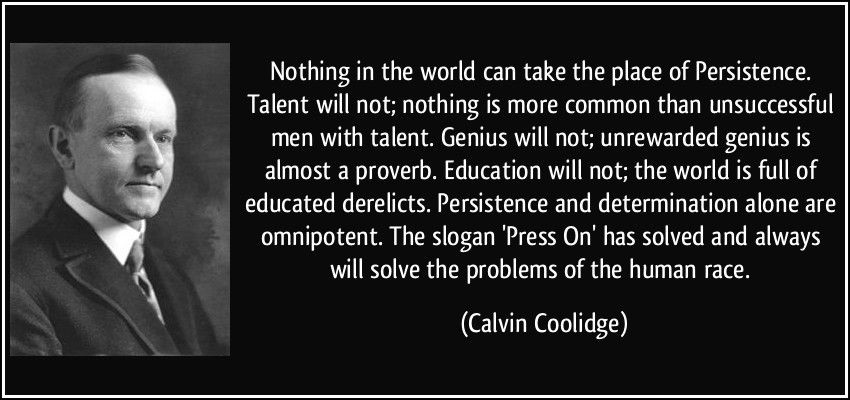

Calvin Coolidge was the 30th president of the United States from 1923 to 1929 and the only United States President in the last 100 years to be re-elected for a second term during a recession.

His determination to ‘Press On’ during the tough times is a lesson to keep remembering.

9 Jun 2022

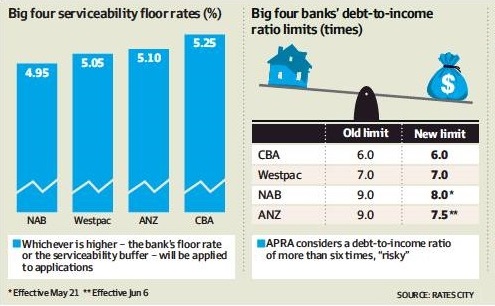

Australian Interest Rates: Stress test

- Posted by Dejan Pekic BCom DipFP CFP GAICD

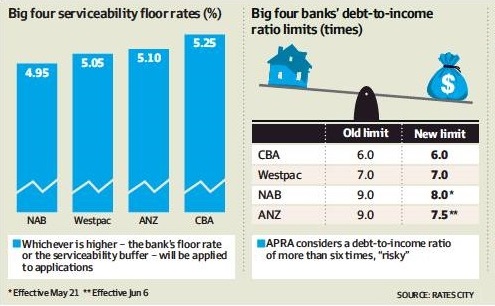

Yes, the RBA (Reserve Bank of Australia) increased interest rates again and yes we have seen this all before.

Over the past 30 years there have been two periods of rapid rising interest rates linked to crashes in asset prices which are defined as a fall of 20% plus since recent peak.

They include the 1994 bond market crisis and the 2000 dot-com bubble (aka the tech wreck) which saw destruction in asset prices.

Interestingly the 2008 global financial crisis which destroyed asset price was then followed by a rapid rise in interest rates.

Click for chart.

The question then is, what will happen this time?

Yes it is likely that interest rates will rise again but there will be a limit because the government cannot afford to financially bankrupt borrows who account for an estimated 30% of Australian households.

The more likely path is a repeat of the interest rate tightening cycle between 2002 and 2007 which was more gradual and measured.

Irrespective, rising interest rates will likely create buying opportunities which is why now is the time to remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

6 Jun 2022

Australian Residential Property: Input Costs

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The ABS (Australian Bureau of Statistics) and HIA (Housing Industry Association) have confirmed what you have all suspected.

That the labour and material costs of building residential property have increased.

The shock however is the number, 40% on average for the past 12 months.

Click for chart.

That is an absurd increase in input costs, cannot be sustained and will likely support residential property prices given the increase in replacement cost.

As input cost shocks such as this work through the economy it becomes even more important to remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

3 Jun 2022

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Today, the first Friday of June each year celebrates National Doughnut Day which was created by The Salvation Army in Chicago in 1938 to honor their members who served doughnuts to soldiers during World War I.

A little something to bring joy because the fall in financial asset prices has not during these past 6 months.

Congratulation to all clients who have used this opportunity to buy more quality assets and now we wait to find out if this correction has ended or whether it will devolve into an asset price crash.

2 Jun 2022

Australian Residential Property: Rising Interest Rates

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The definition for an asset price crash is a fall of 20% plus since recent peak.

For 30 years residential property prices in Australian capital cities have failed to crash, corrected yes but no 20% plus fall in the asset price for residential property.

The recession in 2020 was expected to deflate residential property prices by a forecast 20% plus but it failed to deliver.

Click for chart.

We have a question.

Will this time be different with bond markets forecasting that the RBA will lift the Cash Rate to 3.0% in the next two years which would mean a standard variable mortgage interest rate of 6.0% per annum?

Remember, remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.