29 Oct 2021

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Vanguard Capital Markets Model (VCMM) is a financial simulator developed to take into account current macroeconomic conditions, equity and bond valuations to forecast distributions of future returns for a wide range of asset classes.

The projections generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modelled asset class in AUD.

What caught our attention in the current quarterly Asset Allocation Report is the significant pessimistic forecast of the likelyhood of a negative 10 year projected nominal return for both Australian listed companies and international listed companies.

Click for chart.

Our thinking, even given such market noise is to just remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

27 Oct 2021

Decarbonisation: Clean & Green

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The World (developed nations especially) are on a path to decarbonisation which is to move to nil or low-carbon power sources to reduce the emission of carbon dioxide into the atmosphere by 2050.

The IEA (International Energy Agency) estimates that US$6.6 trillion will need to be spent on clean energy and green infrastructure over the next 30 years. However there are estimates of between US$20 trillion and US$50 trillion needed to improve industrial processes across the World.

Click for chart.

Bottom line, the spend is going to be large, very large to Net Zero by 2050 which presents a megatrend investment opportunity.

WARNING, this does not constitute Personal Advice and is general in nature. To discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

25 Oct 2021

Australian Billionaires

- Posted by Dejan Pekic BCom DipFP CFP GAICD

It took 30 years but Tony Wall, age 57 finally made it into the AUD$1 billion plus club.

A Wollongong boy who went straight to work from Port Kembla High School, attending University part time and spending all his spare time programming computers.

He is living proof that Australia is a land of opportunity if you have the determination to succeed.

Click to read.

21 Oct 2021

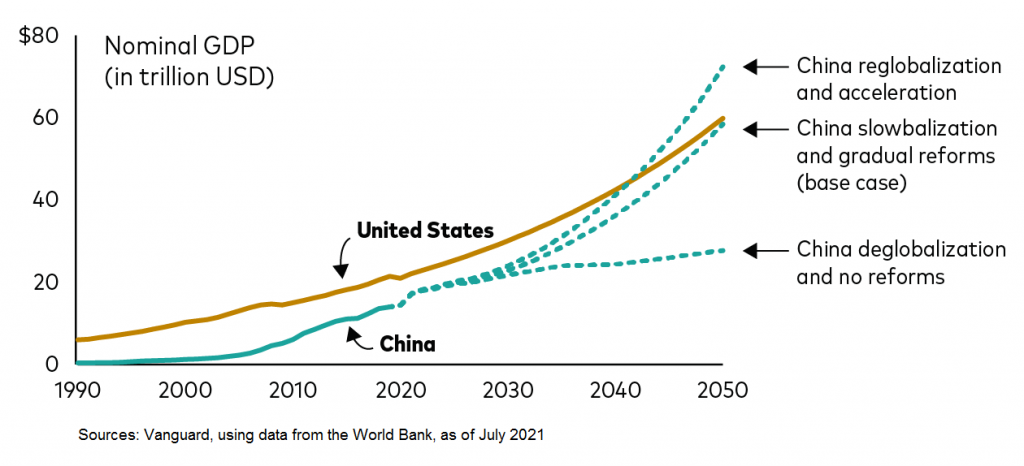

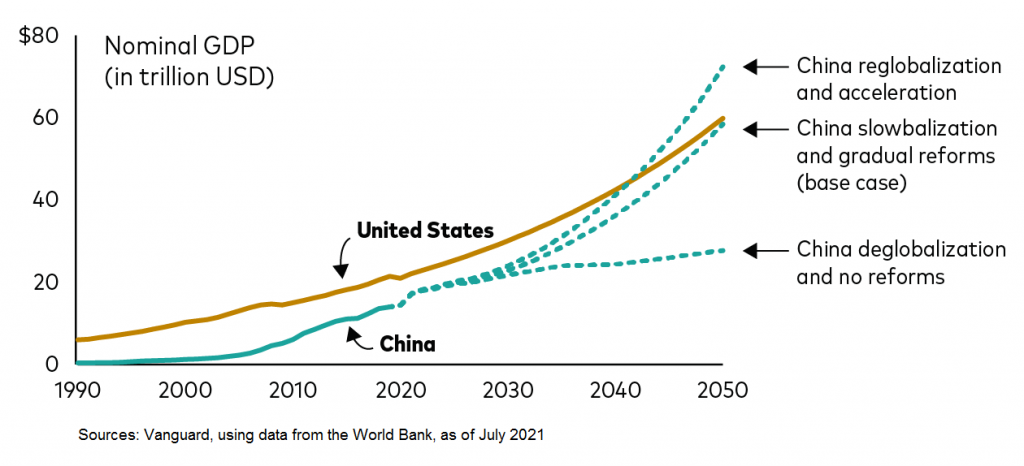

Megatrends: Which China will we get

- Posted by Dejan Pekic BCom DipFP CFP GAICD

China is forecast to surpass the United States of America in economic size by 2050.

However if China decides not to reform domestically (continue with draconian communist economic policy) then it is more likely that the Chinese economy will suffer long term economic stagnation as growth falls below 2% per annum.

This would be bad because a slowing China will also have a negative economic impact on Australia.

Click for research.

15 Oct 2021

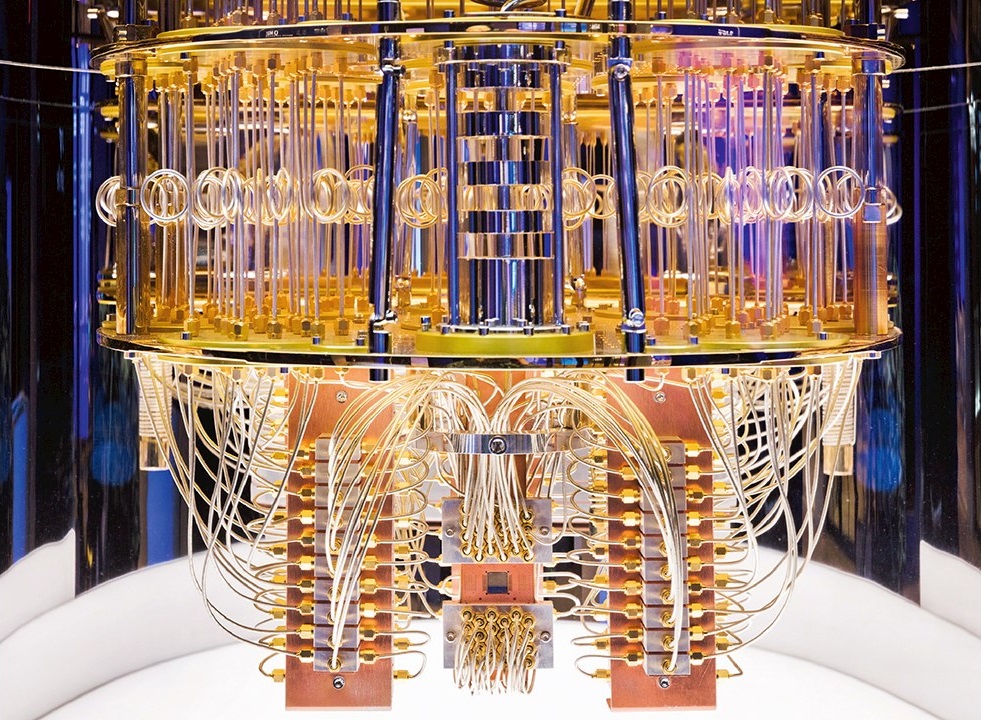

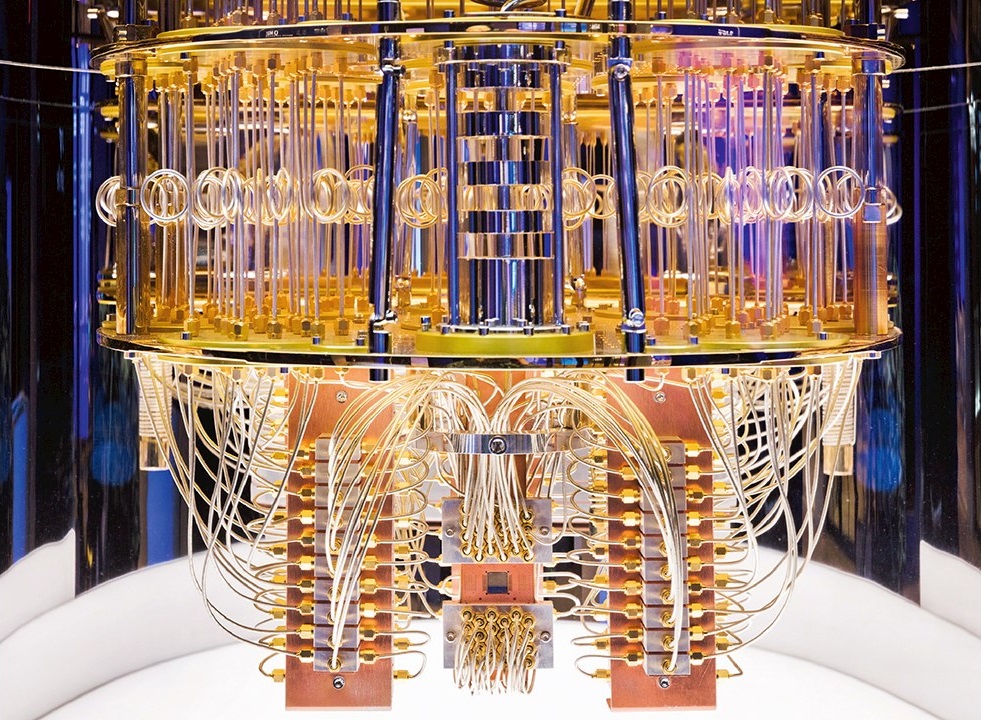

The Boston Consulting Group: Quantum Computing

- Posted by Dejan Pekic BCom DipFP CFP GAICD

According to Investopedia, quantum computing is the study of how to use phenomena in quantum physics to create new ways of computing. Quantum computing is made up of qubits and unlike a normal computer bit which can be 0 or 1, a qubit can be either of those or a superposition of both 0 and 1.

This means that quantum computers can perform calculations in a few seconds for which current supercomputers would need decades or even millennia.

The challenge however is that it is very difficult to maintain qubits quantum states because they suffer from quantum decoherence and state fidelity which requires error correction.

This issue will be solved, it is only a matter of time and then quantum computing will open up a whole new universe of investment opportunity. It will transform everything.

Click to read.

12 Oct 2021

Australian Billionaires

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Jack Cowin is 79 years of age, worth AUD$5 billion and has no plans to retire.

He is living proof that Australia is a land of opportunity if you have the determination to succeed.

Here are his 13 lessons for life.

Click to read.

8 Oct 2021

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The smarts at the California Institute of Technology have created LEONARDO which is short for LEgs ONboARD drOne.

This is a drone that can walk, hop, skateboard and more.

Just amazing, enjoy.

Click to watch.

7 Oct 2021

Company Directors: DIN

- Posted by Dejan Pekic BCom DipFP CFP GAICD

To be a Company Director is to be in a position of high public trust.

Many Company Directors are responsible for hundreds of millions of dollar of assets and it will now be easier to track them throughout their professional career to see how successful or how destructive they have been at managing assets on behalf of shareholders.

All current and new Company Directors will need to get a Director Identify Number (DIN) through the new ABRS (Australian Business Registry Services).

If you are a Company Director on or before 31 October 2021 you will have until 30 November 2022 to apply for your DIN.

Click for DIN.

This is one compliance measure that is long overdue given the number of criminal and or incompetent Company Directors that have destroyed shareholder wealth over the past 30 years.