30 Aug 2021

A New Economic Cycle: Reflation

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The IMF (International Monetary Fund) is forecasting a global reflation cycle with faster economic growth, higher inflation, ongoing monetary stimulus and fiscal stimulus all because of the pent-up demand resulting from supply shortages caused by the COVID-19 pandemic.

If correct this means a global spending boom over the next 2 years.

Click for chart.

This is good news for economies, good news for business and good news for investors.

The only problem is that forecast are often misleading.

As Benjamin Graham taught, just remain invested according to your appetite for volatility and when fear and panic take hold, react by buying more quality assets at discounted prices.

27 Aug 2021

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Spoke with Steven Bear who has been a client since 2015 and we got on to the topic of giving.

Discovered that he ran a Sony Foundation Children’s Holiday Camp for years and years which is a respite program that sees High School and University students take on the responsibility for the care of children with disability and so allow their families to have a weekend off.

Truly inspirational and to all of you out there who volunteer and give we thank you from the bottom of our heart.

Well done Steven and well done Sony.

Click to watch.

25 Aug 2021

Australian Residential Property

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Growth assets as defined by Benjamin Graham (pictured) are assets that can go both up and down in price.

This means that shares in a company are a growth asset and so is property by definition.

The challenge for a vast number of Australians, especially Sydney siders is that they agree that residential property is a growth asset but do not believe that the price can drop which is simply wrong.

The attached research details a residential property in Sydney that is likely to sell below its 2016 purchase price.

Click to read.

What does this tell us?

One, that property prices just like share prices do go down.

Two, the price you pay when investing is what matters. Overpay, even for the highest quality growth asset and it could be years or even decades before you make a profit.

Three, a large amount invested in a single growth asset does not protect your wealth because it offers no diversification.

Need help, call us to book in a conference call time.

24 Aug 2021

Market Metrics: Market Cap

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Market Cap (market capitalisation) refers to the total dollar market value of a company’s shares.

The first company to reach US$1 trillion valuation was Apple back in August 2018 and today, only 3 years later there are 6 listed companies worth US$1 trillion plus.

In order of market cap they are- Apple, Microsoft, Saudi Aramco, Alphabet, Amazon and Facebook with both Apple and Microsoft already having moved past US$2 trillion.

Interesting only one is a non-tech company which reminded me of a line I read earlier this century and that was… ‘software will consume the World‘.

Click for chart.

The valuations just keep on punching higher and higher which why it is so important to remain invested according to your appetite for volatility and when fear and panic do take hold, react by buying more quality assets at discounted prices.

20 Aug 2021

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Forget supersonic, this is hypersonic.

In only a few years you will be able to fly from New York to London in under an hour.

The Hermeus Quarterhorse has a projected top speed of Mach 5.5 or 4,219 mph that will make it the fastest reusable jet on the planet.

You just cannot stop human imagination.

Click to read.

17 Aug 2021

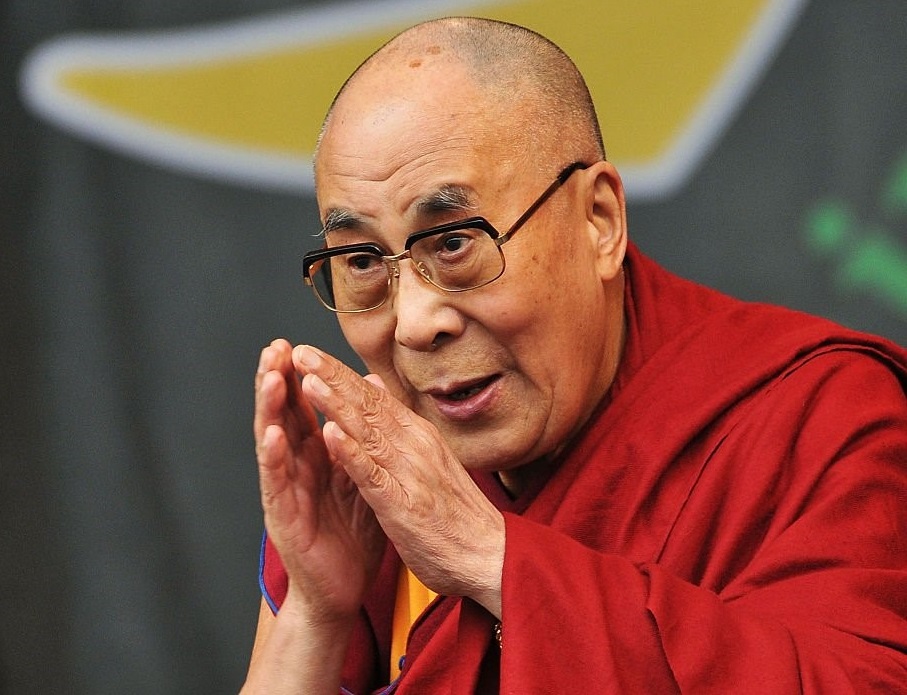

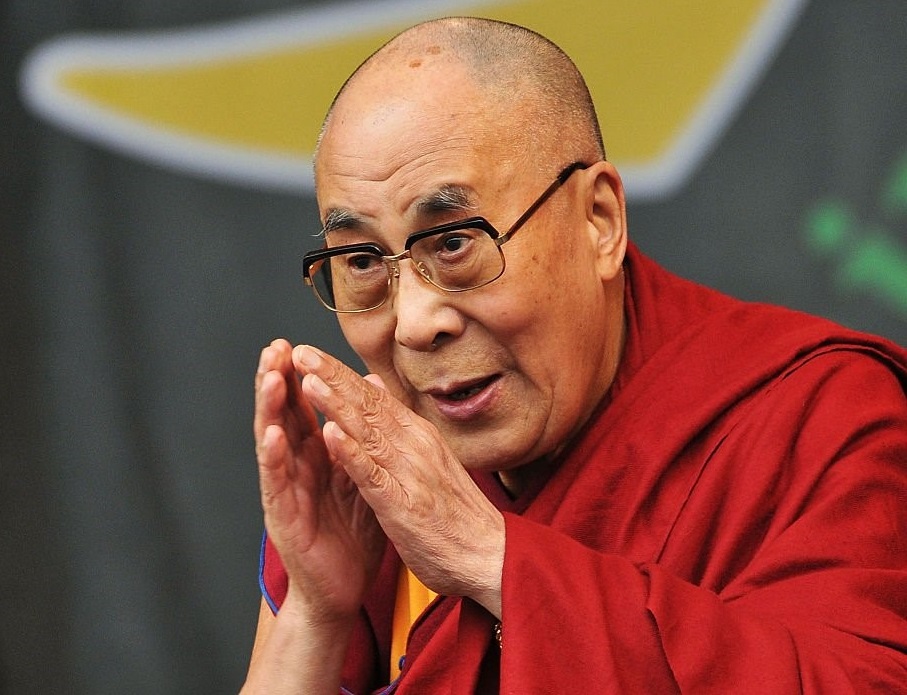

Dalai Lama: Afghanistan

- Posted by Dejan Pekic BCom DipFP CFP GAICD

What an unmitigated disaster.

This war has lasted 20 years, cost the United States of America over US$2 trillion, 6,500 American lives and 167,000 Afghan lives.

Plus let’s not forget about the casualties.

Click for Forbes.

Just imagine how much better the quality of all life on this planet would be if we just followed the teachings of the Dalai Lama.

Click to read.

12 Aug 2021

Japanese Reflation

- Posted by Dejan Pekic BCom DipFP CFP GAICD

No matter which way we look at today’s economic conundrum, we keep arriving at the same conclusion and that is that the World is turning Japanese.

Japan mass printed money for well over two decades in an attempt to drive economic growth following its property and stock market collapse in 1991 but the strategy has failed.

Mass printing money has lead to the creation of a vast debt pile for Japan and coupled with zero population growth the result has been low growth, low interest rates and low inflation.

If this sounds familiar it should because the United States, China and the Eurozone are all in exactly that same situation.

They have all increased debt and Total Debt to GDP (Gross Domestic Product) for the United States, China and the Eurozone has now almost reached 300% for all three while population growth is effectively zero with the United States at 0.5%, China at 0.4% and the Eurozone at 0.1%.

Click for charts.

Mass debt piles plus zero population growth can only mean that low growth, low interest rates and low inflation are the most likely economic outcomes for the United States, China and the Eurozone for the next 10 years at a minimum.

Yes our thinking could be wrong but struggling to see how the United States, China and the Eurozone are going to overcome their already insane debt piles when they just keep printing more and more money.

9 Aug 2021

Digital Scammers: Shipping Containers

- Posted by Dejan Pekic BCom DipFP CFP GAICD

It has been email for quite some time and then came robo calls and now advertising through Facebook and Google.

Digital scammers are paying Facebook and Google to lure buyers into making purchases on fake websites.

Click to read.

The amount of digital fraud is accelerating exponentially with Juniper Research estimating that the cumulative losses from online payment fraud for e-commerce, banking services, airline ticketing and money transfer will pass US$200 billion for the period 2020 to 2024.

This is beyond ridiculous.

3 Aug 2021

Decarbonisation

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The World (Developed Nations in the main) are on a path to decarbonisation which is to move to nil or low-carbon power sources to reduce the emission of carbon dioxide into the atmosphere by 2050.

This will require a great deal of new investment into infrastructure and industrial processes across the World with the spending estimates ranging from US$20 trillion to US$50 trillion over the next 30 years.

Attached is a pathway from the IEA (International Energy Agency) on the policy changes and technological innovation needed to achieve Net Zero by 2050.

Click for chart.

We are in no doubt that the path to Net Zero by 2050 is an investment megatrend which our clients are already taking advantage of by way of select PM (Portfolio Managers) that we have recommended and a trend which will continue to present new investment opportunities over the coming decades.