16 Mar 2021

Market Metrics: Bond Yields

- Posted by Dejan Pekic BCom DipFP CFP GAICD, Senior Financial Planner

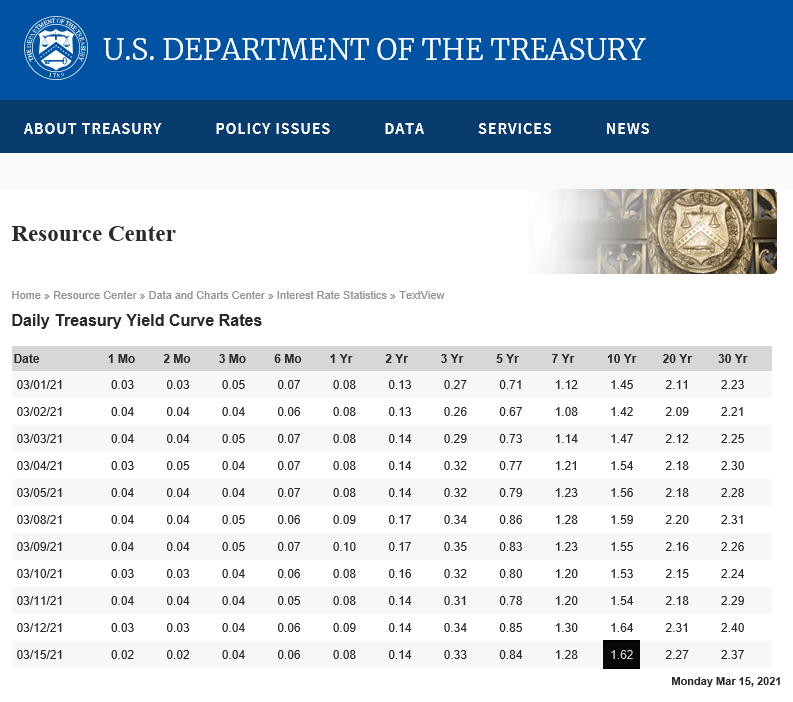

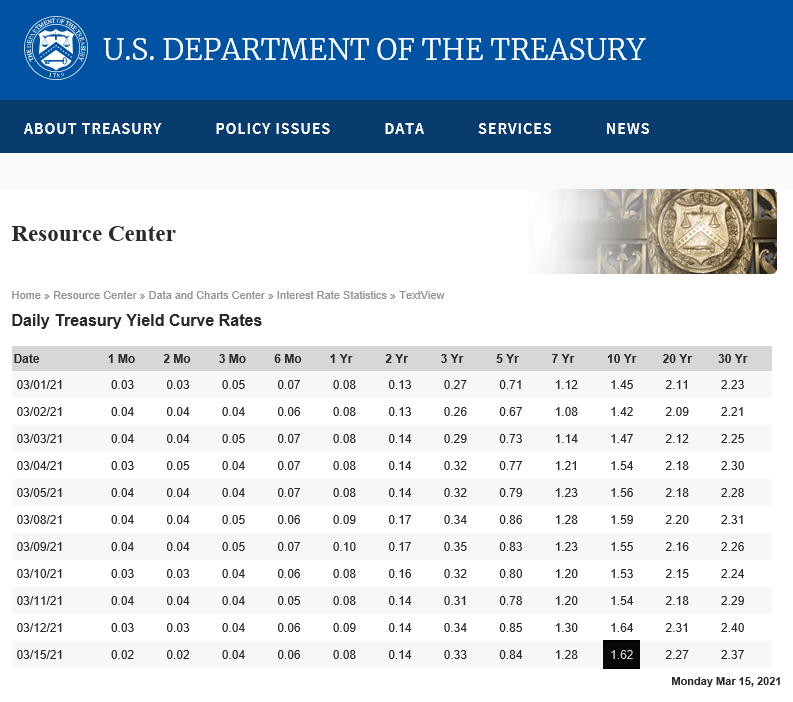

Why has the US 10 year bond yield risen from 0.52% on 4th August 2020 to 1.62% as at 15th March 2021 or 1.10%?

Answer, because the news for economic growth is positive.

The Purchasing Managers Index (PMI) has risen sharply back above 50 from the collapse in 2020 which indicates that World GDP is expected to rise through 2021 and consequently bond yields are rising.

Click for chart.

Rising bond yields are almost always bad news for growth assets prices (property and shares) and bad news for defensive assets prices (bonds).

The only positive news is for cash however it is difficult to see bond yields continuing their rapid rise because global debt is over US$277 trillion or 365% of World GDP as at the end of 2020.

The World is awash with debt, that is the elephant in the room and to take the US 10 year bond yield back up to even 4.00% would collapse prices for both growth assets and defensive assets.

As Benjamin Graham taught, remain invested according to your appetite for volatility and if bond yields do explode upwards causing fear and panic to take hold, then react by buying more quality assets at discounted prices.

WARNING, this does not constitute Personal Advice and is general in nature. To discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

At Newealth we are always looking to support and promote our clients wherever possible and if you have any ideas or comments, please feel free to email me or to call me on +61 2 9267 2322.