30 Jul 2020

Market Metrics: S&P 500 Index

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We are currently in the midst of the COVID-19 Pandemic, consumer sentiment has dropped materially (26.3% in United States) and yet the Standard and Poor’s 500 Index which measures stock price performance of 500 large listed companies in the United States is going in the other direction.

How?

The big driver has been the information technology companies which is now 27.5% of the S&P 500 Index as at 30 June 2020 and this is largely due to FAANGM (Facebook, Apple, Amazon, Netflix, Google and Microsoft) which have increased over 500% in the past 7 years and are again rebounding since the -37% crash in March 2020.

The other big driver has been the United States Federal Reserve which has been buying billions of dollars of corporate bonds since 22nd March 2020 under The Secondary Market Corporate Credit Facility (SMCCF) and so is helping companies to stay afloat.

Click for charts.

So what do we do about this disconnect? Nothing because as Benjamin Graham taught, don’t speculate.

Instead, remain invested according to your appetite for volatility and when fear and panic take hold again, then react by buying more quality assets at discounted prices.

28 Jul 2020

Australian Taxation Office (ATO): Income Tax

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The good news is that for the current financial year ending 30 June 2021 there will be no increase in taxation rates.

However, for those clients earning over $180,000 you will still be liable to pay 45% marginal rate of tax plus the 2% Medicare levy plus the 1.5% Medicare levy surcharge which adds to a total rate of 48.5%.

Minors (children under age 18) will still pay a 66% marginal rate of tax if their investment income is over $416 in the financial year.

The good news is that the company tax rate for business with turnover of less than $50 million has dropped from 27.5% to 26% and will further drop to 25% in the financial year ending 30 June 2022.

That is a win for the Australian economy.

Click for Facts & Figures.

These taxation rates should serve as a strong reminder for why taking advantage of your individual $1.6m total superannuation balance cap is so very important given that the maximum tax rate on earnings in superannuation is 15% which then drops to 0% when the money is rolled over into the pension phase of superannuation.

It is a categorical fact that the biggest cost to investing is taxation.

Consequently, an investment strategy that can help you reduce taxation (must be legal) should be used for its advantage provided that it is sound and likely to make profit.

23 Jul 2020

Returning People to the Workplace Safely: Economic Impact COVID-19

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Work and the workplace have most definitely changed.

What a business needs to output has not fundamentally changed but the process and execution has had to materially adapt in order to survive the COVID-19 Pandemic.

The attached guide on returning employees to the workplace is very good with lots of practical solutions.

Click to read.

21 Jul 2020

Market Metrics: Dow Jones Industrial Average (DJIA)

- Posted by Dejan Pekic BCom DipFP CFP GAICD

What’s happening?

Nothing.

The DJIA has rebounded from the March 23rd low to a mini peak of 27,572 on the 8th June 2020 and for the past 6 weeks has been range trading, which means tracking sideways while waiting for Mr Market (an allegory created by Benjamin Graham) to work out which way he wants to go.

Click for chart.

This is normal, financial market asset prices regularly track sideways for short and long periods of time.

The challenge for Mr Market is trying to figure out whether the worst of the economic impact of the COVID-19 Pandemic is behind us or if there is still more to come.

Our role as investors is to patiently wait and see if Mr Market falls back into one of his manic depressive moods and if he does, to then take advantage of him again by buying more quality assets at discounted prices.

If you want to find out how you can take advantage of the current situation, please call me on 02 9267 2322.

16 Jul 2020

2020 US Presidential Election

- Posted by Dejan Pekic BCom DipFP CFP GAICD

In 2016 they said that it was the race that he would not win and yet Donald Trump was elected the 45th President of the United States of America.

Our professional expectation was that Donald Trump would win a second term in 2020 however that was before COVID-19 and the global recession.

History paints a difficult picture for a sitting President during a recession.

In fact only one United State President, Calvin Coolidge (pictured above) in the last 100 years has survived to be re-elected for a second term during a recession and that was back in 1924.

Donald Trump brings a great deal of chaos and disorder to the Office of the President of the United States and it would be better if he goes sooner rather than later.

Click for chart.

14 Jul 2020

Cost of Living in Retirement (Part 2): How much do I need?

- Posted by Dejan Pekic BCom DipFP CFP GAICD

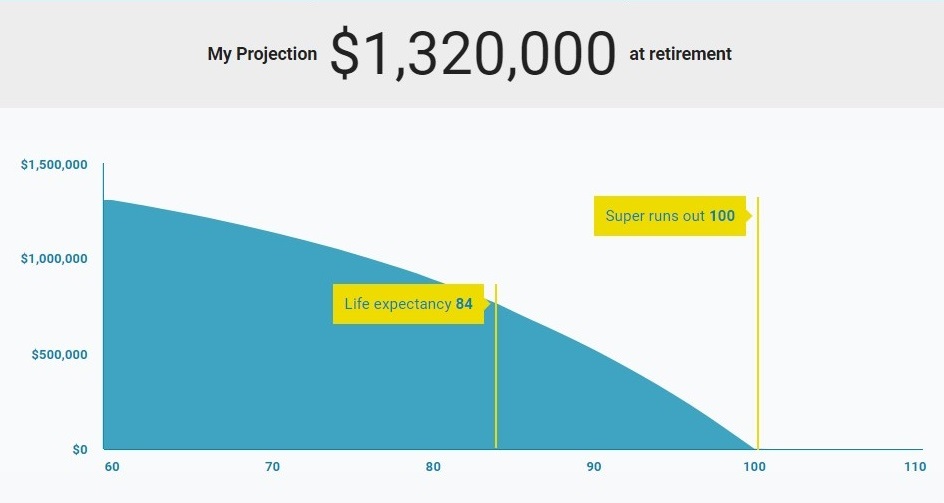

Yesterday’s ASFA Retirement Standard raised a number of questions including what number is needed to fund a ‘comfortable lifestyle’ in retirement starting from the earlier age of 60.

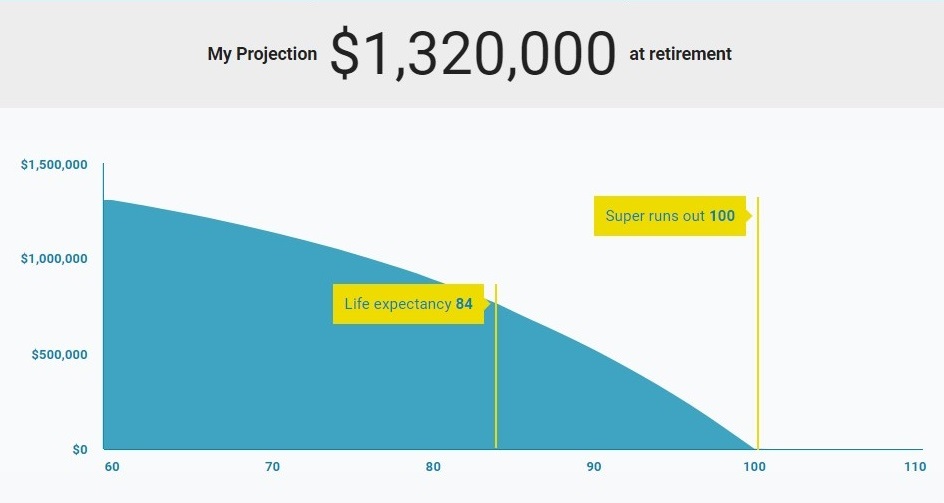

Again, assuming a 6.9% per annum rate of return and an inflation rate of 3.0% per annum (currently 2.2% per annum according to RBA) for a couple aged 60 today, they will need $1,320,000 in addition to owning their home to receive $62,435 per annum in real terms for 40 years after which time the capital will be exhausted.

See above chart of retirement balance projection for a couple age 60 today.

If you are an Active client and have questions about what else you can do to accumulate capital for retirement, please call me on 02 9267 2322.

13 Jul 2020

Cost of Living in Retirement: How much do I need?

- Posted by Dejan Pekic BCom DipFP CFP GAICD

A ‘comfortable lifestyle’ in retirement is one that allows for a broad range of leisure and recreational activities and to have a good standard of living through the purchase of things such as household goods, private health insurance, a reasonable car, good clothes, a range of electronic equipment and domestic plus occasionally international holiday travel.

According to ASFA (Association of Superannuation Funds of Australia) you need $62,435 per annum if you are a 65 year old retired couple who owns your own home and wants to meet this definition of a ‘comfortable lifestyle’ in retirement.

Click for table.

If we assume a 6.9% per annum rate of return and an inflation rate of 3.0% per annum (currently 2.2% per annum according to RBA) and if you are age 65 today you will need $1,230,000 in addition to owning your own home to receive $62,435 per annum in real terms for the next 35 years after which time the capital will be exhausted.

Alternatively, a couple could rely on the Age Pension but it will only pay $37,014 per annum and the couple will need to wait unit age 67 to qualify if born after 1 January 1957.

| Date of Birth Qualification |

Pension Age |

| 1 January 1949 to 30 June 1952 |

65 |

| 1 July 1952 to 31 December 1953 |

65 years and 6 months |

| 1 January 1954 to 30 June 1955 |

66 years |

| 1 July 1955 to 31 December 1956 |

66 years and 6 months |

| On or after 1 January 1957 |

67 years |

The Age Pension also has an Asset Test which will result in disqualification where a couple homeowner currently has over $876,500 in assets in addition to their home.

Click for chart.

We have been asked ‘How much do I need’ for three decades and what we know is that pursuing an Age Pension strategy for retirement is NOT recommended.

The current number is $1,230,000 today in addition to owning a home and should serve as a stark reminder of why it is important to keep saving and accumulating for retirement.

9 Jul 2020

Market Metrics: 30 June 2020

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Gold is a store of wealth.

This is undisputed fact and has been the case for millennia however the problem with investing in gold is that it does not multiply. A bar of gold does not produce baby gold ingots.

Gold is also purchased heavily during times of significant fear as has been the case over the past 6 months.

Almost all asset prices (stocks, commodities, currency and interest rates) have posted a negative return apart from gold which has jumped a massive 27.4% for the 12 months to 30 June 2020.

Click for chart.

Now before everyone suffers a bout of gold fever we remind you of one of Warren Buffett great quotes for investing…“Be fearful when others are greedy. Be greedy when others are fearful.”

Mr Market is definitely fearful at present and it is always a good time to buy more quality assets when prices are discounted.

WARNING, this does not constitute Personal Advice and to discuss if this is appropriate for your given circumstances please do not hesitate to contact us directly.

3 Jul 2020

Friday Tidbit: The Pursuit of Happiness

- Posted by Dejan Pekic BCom DipFP CFP GAICD

According to Harvard University research, the secret to feeling so much happier for adults over the age of 50 is to regularly volunteer and help others.

It was found that volunteering elevates contentment and your sense of well being.

Further, individuals who routinely help other people had lower overall risk of death, diminished odds of developing health complications and higher levels of physical activity.

Now we have proof, humans are social creatures and so our minds and bodies are rewarded when we give to others.

The secret to happiness is GIVING.

Click for the research paper.

1 Jul 2020

Market Metrics: 30 June 2020

- Posted by Dejan Pekic BCom DipFP CFP GAICD

What a financial year!!!

Asset prices of listed Australian and American companies fell by 37% from the February 2020 peak to the March 2020 low.

This has been the first financial markets crash (defined as a drop of 20% or more from recent peak) since the 2008 Global Financial Crisis.

It has taken 12 years and although both the Australian and the United States indices were up on the last trading day of the financial year, the 1 year return is -7.13% for the ASX200 and -0.54% for the DJIA.

Click for charts.

Although we are in the midst of a recession, the economic numbers are improving but not for all industries and as always, if you are an Active client that has questions on how to take advantage of the current situation, please call me on 02 9267 2322.