26 Feb 2020

Return Expectations: The Big Shift

- Posted by Dejan Pekic BCom DipFP CFP GAICD

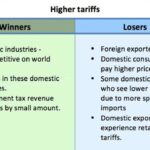

Back in 2010 an investor could achieve a 4.0% per annum return without taking large risk with the capital invested by purchasing government and or corporate bonds.

Today, to get the same return an investor has to take more than double the risk.

The collapse of interest rates globally has caused a big downward shift in the risk return profile for all asset classes and the hard truth is that we will need to accept less capital accumulation for retirement.

Click for chart.

However all is not lost because even with forecasted lower rates of return, regular disciplined saving will still have a material positive impact on the final size of your capital accumulation for retirement.

21 Feb 2020

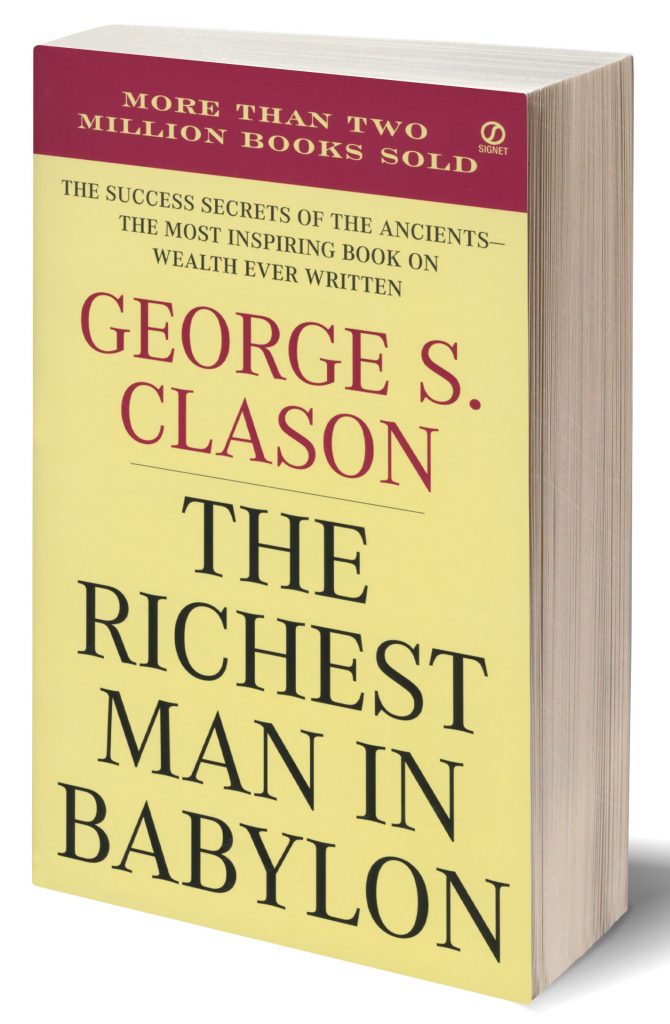

The Five Laws of Gold

- Posted by Dejan Pekic BCom DipFP CFP GAICD

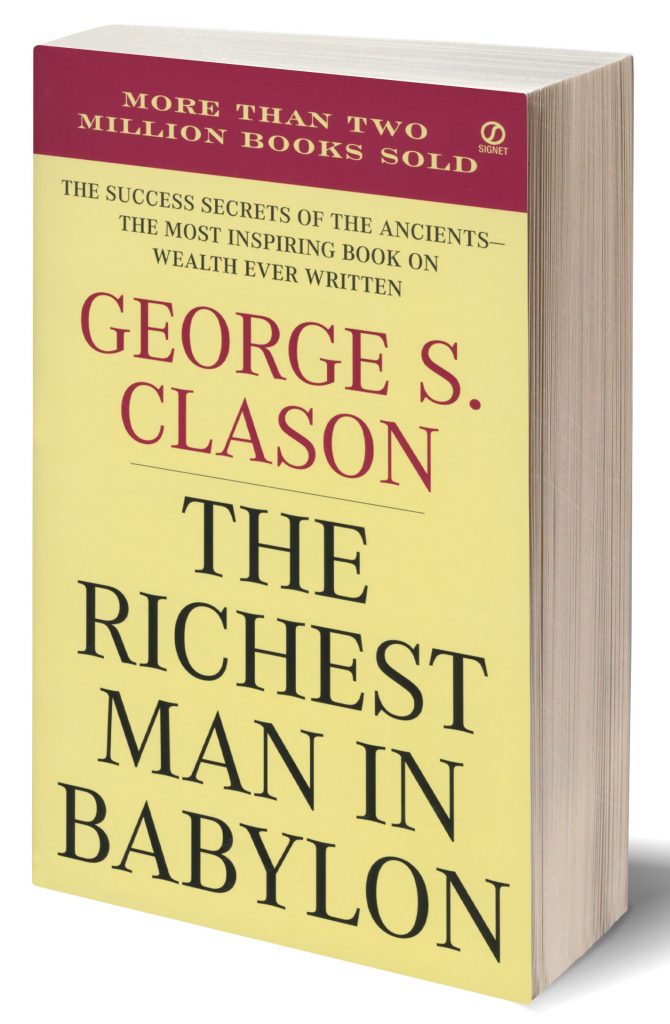

In 1926 George S Clason first published a famous series of pamphlets on thrift and financial success using parables from ancient Babylonian clay tablets.

These pamphlets were latter incorporated into his book, The Richest Man in Babylon and the following five laws of Gold are from that book-

The First Law of Gold

Gold cometh gladly and in increasing quantity to any man who will put by not less than one-tenth of his earnings to create an estate for his future and that of his family. This law always sayeth that the more Gold I accumulate, the more readily it comes to me and in increased quantities.

The Second Law of Gold

Gold laboureth diligently and contentedly for the wise owner who finds for it profitable employment, multiplying even as the flocks of the field. Gold indeed is a willing worker. To every man who hath a store of Gold set by, opportunity comes for its most profitable use.

The Third Law of Gold

Gold clingeth to the protection of the cautions owner who invests it under the advice of men wise in its handling. Gold, indeed, clingeth to the cautious owner, even as it flees the careless owner.

The Fourth Law of Gold

Gold slipped away from the man who invests it in businesses or purposes with which he is not familiar or which are not approved by those skilled in its keep. Therefore, the inexperienced owner of Gold who trusts to his own judgment and invests it in business or purposes with which he is not familiar, too often finds his judgment imperfect, and pays with his treasure for his inexperienced.

The Fifth Law of Gold

Gold flees the man who should force it to impossible earnings or who followeth the alluring advice of tricksters and schemers or who trusts it to his own inexperience and romantic desires in investment. Fanciful propositions that thrill like adventure tales always come to the new owner of Gold.

If you substitute the word Gold for Money, has anything really changed in the 8,000 years that have elapsed since ancient Babylon times when it comes to accumulating wealth?

14 Feb 2020

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Why can’t we focus anymore?

Could it be because focused single tasking is thought to be less efficient than its sophisticated (and overrated cousin) multitasking?

Enjoy the insightful read.

Click to read.

13 Feb 2020

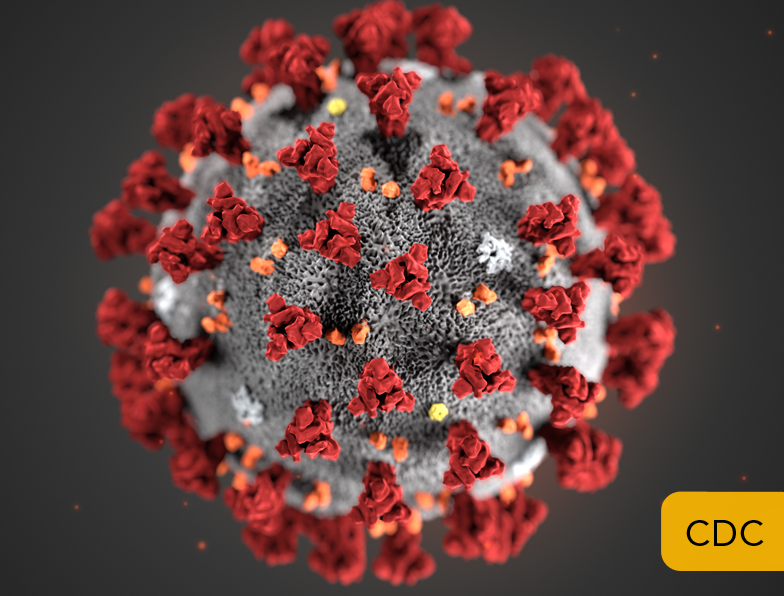

Coronavirus outbreak: What it means for markets

- Posted by Dejan Pekic BCom DipFP CFP GAICD

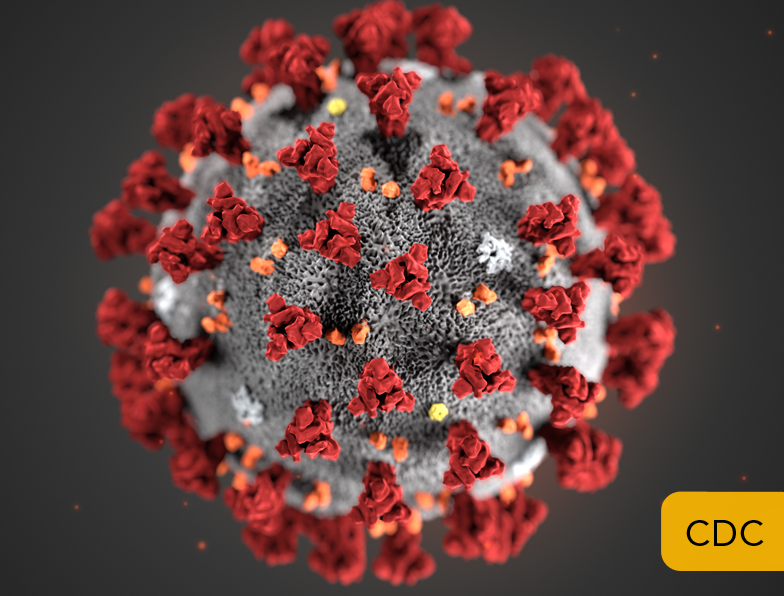

Clients are asking questions about the potential impact on global economic growth and financial markets.

You could expect to see a sizable decline in consumer spending and manufacturing activity in China and reduced tourism, luxury goods spending and commodities purchasing but it has not materially impacted financial markets.

Why because viral outbreaks similar to this have occurred in the past with minimal impact on financial markets.

Click for chart.

Note however, if the situation was much worse, for instance if the Coronavirus had a 100% death rate then there would be global panic and financial markets would be in chaos.

5 Feb 2020

22 Coal Power Plants

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Don’t understand.

The Japanese are forward thinking and have chosen to return to coal.

Click to read.

Bill Gates, billionaire philanthropist and Microsoft Founder has a safe nuclear clean energy solution.

In Part 3 of the series ‘Inside Bill’s Brian’ he presents a safe nuclear solution which will use the current stockpiles of nuclear waste and also reduce pollution from fossil fuel consumption.

The old generation nuclear power plants are lethal and should be decommissioned and replaced with safe nuclear plants.

Click to watch.

4 Feb 2020

Market Metrics: S&P/ASX200

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Question, are current valuations stretched in the Australian stock market?

Attached is price to earnings chart (P/E ratio) to 31 December 2019 for the top 200 listed companies in Australia.

The price to earnings ratio is used as a measure of a company’s share price to its earnings per share. Generally a lower P/E is better because it implies that you are paying a lower price but as with all indicators this does not always hold true.

Comparing the P/E ratio over the past 14 years implies that the top 200 listed companies in Australia are stretch with the biggest trouble coming from the extreme valuation in the technology and healthcare sectors.

Click for chart.

The message for investors however is unchanged and that is to remain invested according to your appetite for volatility and when fear and panic take hold during the next financial catastrophe, to take advantage by buying more quality assets at discounted prices.