30 Aug 2019

Friday Tidbit: Australian Economy

- Posted by Dejan Pekic BCom DipFP CFP GAICD

If you want to keep an economy growing then you need capex (meaning capital expenditure) which comes from Business.

Business capital investment has been falling in aggregate since 2013 but the good news is that it is predicted to rise in 2020 led by mining sector.

If the Government wants people in jobs then it needs to incentivise and stimulate the economic engine room which is business and not over-regulate in the process.

Yes it is a fine line and if it is not navigated successfully, an economic downturn (recession) will follow.

Click for chart.

28 Aug 2019

Commodity Price Super Cycle: Resources

- Posted by Dejan Pekic BCom DipFP CFP GAICD

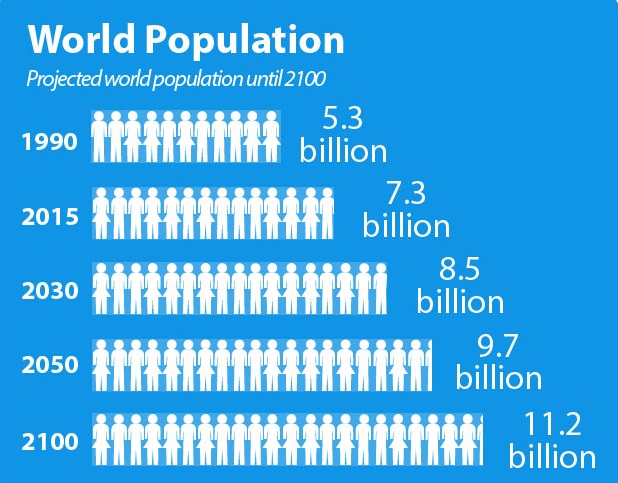

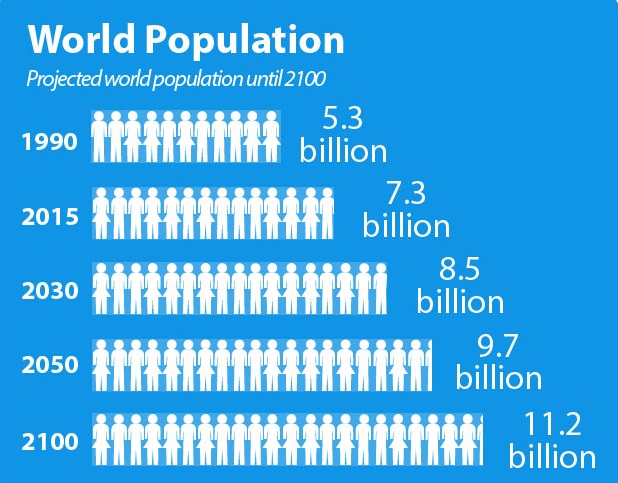

This is a real challenge for humanity because the planet wide population is expected to increase from 7.7 billion today to 9.7 billion by 2050.

As incomes rise in the emerging World this adds to the number of people eating meat (soft commodities) and increases the need for more buildings, roads, transport and utilities (hard commodities) which is all bad news for the environment.

The attached chart points to the end of the current price super cycle in hard and soft commodities but it is difficult to believe given that humanity will add another 2 billion human beings to the planet is just the next 30 years.

Thinking forward, it is more likely that the current price falls reverse and the super cycle climbs much higher because earth’s resources are not infinite.

Click for chart.

20 Aug 2019

Behavioral Finance: Rollercoaster of investment emotions

- Posted by Dejan Pekic BCom DipFP CFP GAICD

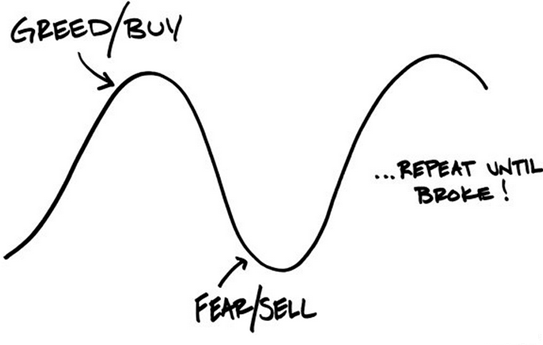

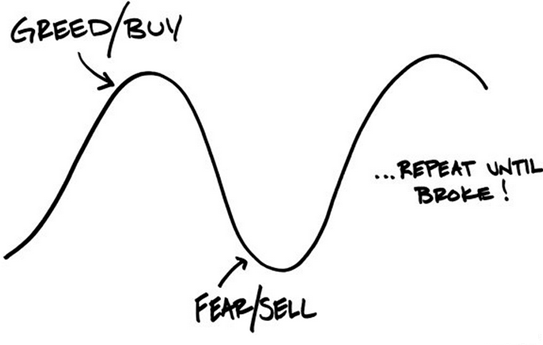

The vast majority of investors are consistently bad at dealing with uncertainty, underestimating some risks and overestimating others.

This behavior has been repeatedly played out over and over again during the past 28 years of my professional career and will continue to be repeated over the next 28 years.

Research into behavioral finance and behavioral economics has uncovered that our cognitive biases lead to our poor decision making are they are not random, in fact these mistakes are systematic and predicable which implies that they can be greatly reduced.

The key to overcoming these cognitive biases as an investor is to be aware of them before making a poor decision.

Click to read.

16 Aug 2019

The Wisdom of Great Investors: Hamish Douglass

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Hamish Douglass is one of Australia’s best PM (Portfolio Managers) and here he shares his insights on successful active investing.

What he has learned-

- Standing on the shoulders of giants

- The power of network effect

- Beware of mistaking companies with high returns on capital or market leadership for outstanding businesses

- Don’t rely on the rear-view mirror

- Your best ideas are often more obvious than you think

- Be careful of stocks trading at low multiples of earnings or those that offer high dividend yields

- Avoid turnarounds

- The magic of compound interest

- Importance of portfolio construction

- Beware of businesses where the competitive advantage is dependent upon government subsidies or vulnerable to government policy

- Know what you don’t know

- Don’t become emotional

- Don’t make the same mistake twice

Most importantly, when fear and panic take hold, that is when an investor is presented with the best opportunity to buy more quality assets at reasonable or better still discounted prices.

Click to read.

13 Aug 2019

US Listed Companies: 1,092 Winners

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This research paper helps to explain the difficulty of using a buy and hold strategy for investing in listed companies.

The research reviews the performance of 25,332 listed companies in the United States across 90 years to discover that only 1,092 listed companies (4.31%) collectively account for all stock market gains above the return from the one month US Treasury Bill rate over the same period.

Furthermore, the return from 9,579 listed companies (37.81%) offset the wealth destruction of the remaining 14,661 listed companies (57.88%) meaning that investing in the bulk 24,240 listed companies would have matched the dollar gains earned from the one month US Treasury Bill rate.

Click for chart.

This is why at Newealth we recommend that clients hire professional management teams to buy and sell listed companies as their valuation (share price) is stretched below and above their intrinsic/enterprise value.

The skills needed by the very best professional managers to work out the intrinsic/enterprise value of a listed company involves a combination of both science and art which is why it is so difficult for part time investors to replicate.

Click for research paper.

8 Aug 2019

US China Trade War: Tariffs

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Our view on tariffs remains unchanged.

The theory is to protect domestic business and protect domestic jobs but in practice everybody loses.

The current US China Trade War began on the 22nd march 2018 when US President Donald Trump signed a memorandum under the Section 301 of the Trade Act of 1974 instructing the United States Trade Representative to apply tariffs on US$50 billion of Chinese goods due to Chinese theft of US intellectual property.

The attached brief provides context on the US China Trade War and highlights how normal and regular it is to have share market corrections (defined as fall of up to 20% fall from recent peak).

The burning question is whether this US China Trade War will devolve into a financial catastrophe or more commonly known as a share market crash (which is defined as a fall of greater than 20% from recent peak) and the answer is that we do not know.

For investors however the key with all of this market noise is to remain invested according to your appetite for volatility and then, when fear and panic take hold during the next financial catastrophe, to take advantage by buying more quality assets at discounted prices.

Click to read.

6 Aug 2019

Australian Inflation: 2000-2019

- Posted by Dejan Pekic BCom DipFP CFP GAICD

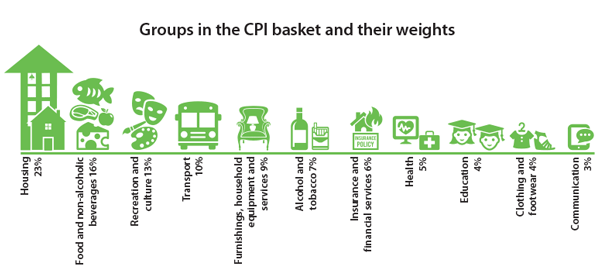

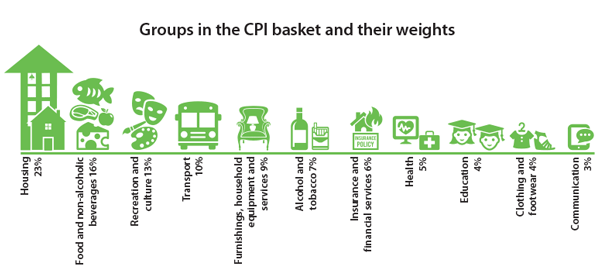

The Reserve Bank of Australia reports the current rate of inflation (also known as Consumer Price Index or CPI) on their website at 1.6% and for most of this century it has stayed well below 5.0% which is good news but is it the real story?

If you consider the cost of education, medical, power, water, insurance and housing you can see that they have increased by as much as double to triple the official rate of inflation.

Click for chart.

Yes it is not all bad news, wages have risen above CPI and some costs have actually fallen in real terms but the results put into question the entire methodology of how the Australian Bureau of Statistics (ABS) measures CPI.

Still unclear on why the methodology has not been updated/adjusted to account for the significant cost increases in education, medical, power, water, insurance and housing to provide a more real world inflation number for Australia.

2 Aug 2019

US Interest Rates: PMI

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This week marks the first interest rate cut by the US Federal Reserve since 2008.

Why did they reduce the benchmark rate by 0.25% to take the range down to 2.00% to 2.25%?

Returns on growth assets are up, especially for the 6 months to 30 June 2019 and interest rates are down.

The Purchasing Managers Index (PMI) may provide some insight because it is a measure of the prevailing direction of economic trends in manufacturing through its monthly survey of supply chain managers across 19 industries, covering both upstream and downstream activity.

When the PMI is falling it indicates that manufacturers are scaling down production because they are expecting reduced sales which can indicate slower economic growth.

Click for chart pack.

The key for investors with all of this market noise is to remain invested according to your appetite for volatility and then, when fear and panic take hold during the next financial catastrophe, to take advantage by buying more quality assets at discounted prices.