30 Jul 2019

Investment Income: Power of reinvestment

- Posted by Dejan Pekic BCom DipFP CFP GAICD

If you take the interest/coupon from a diversified fixed interest portfolio or the rent from a diversified property portfolio or the dividend from a diversified share portfolio and reinvest that income distribution you will compound the asset value higher over time.

This works on the assumption that you can purchase more assets with the investment income.

Alternatively you can choose to spend/consume the investment income which will significantly slow the rate of growth.

The attached chart illustrates the benefit of reinvesting dividend income over 20 years as an example. A powerful outcome for any balance sheet.

Click for chart.

26 Jul 2019

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The Australian All Ordinaries Index (AORD) closed at a record high of 6,853 on 1st November 2007 and subsequently fell to a low of 3,111 on 6th March 2009 which represents a crash of 54.6%.

You may have not noticed but on Wednesday the 24th July 2019 the AORD finally closed at 6,862 to record a new all-time record high. It only took a bit over 11 years and 8 months.

The AORD has subsequently gone higher again and now the wait is on to see how much higher it can go before we suffer our next financial catastrophe.

Fortunately, history and experience tells us that we should expect more ups than downs.

Click for chart.

For investors, the key is to remain invested according to your appetite for volatility and when fear and panic take hold during the next financial catastrophe, to take advantage by buying more quality assets at discounted prices.

19 Jul 2019

Australia Household Wealth

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Hard to argue the fact that averages can be very misleading as a guide to what is the reality of a situation.

Median calculations (the hump in the statistical bell curve) is more often the best guide for what is the majority case.

It appears that most Australians are not as wealthy as the average figures state.

Click to read.

12 Jul 2019

Friday Tidbit

- Posted by Dejan Pekic BCom DipFP CFP GAICD

We are pro-business but don’t understand.

How can any business justify paying one single employee US$129.4m for one year of work.

Something must be broken when by comparison an average income of US$75,000 per annum equates to only US$3m after 40 years of work.

The Board of Directors is responsible for this outcome.

The Board of Directors represent the shareholders that own and invest in the business (us) and it is they that approve the remuneration policy of the Chief Executive Officer.

Again, don’t understand.

Click for numbers.

10 Jul 2019

Behavioral Finance: Momentum Investing

- Posted by Dejan Pekic BCom DipFP CFP GAICD

As Benjamin Graham taught, you are not right because the Mr Market agrees with you, you are right because your numbers are right.

Even intellectual geniuses such as Sir Isaac Newton can get completely caught up with the emotion of investing and blow up their portfolio.

WARNING, chasing higher and higher prices is no guarantee of future return.

Click to read.

For investors, the key is to remain invested according to your appetite for volatility and when fear and panic take hold during the next financial catastrophe, to take advantage by buying more quality assets at discounted prices.

4 Jul 2019

Interest Rates: How long can rates remain low?

- Posted by Dejan Pekic BCom DipFP CFP GAICD

History tells us that rates (using US long term government bond yields as a proxy) can remain low for decades at a time.

Click for chart.

The biggest impediment to rising interest rates is the quantum of debt and this has not changed for over a decade.

In January 2019 Bloomberg published an estimate of total global debt at US$244 trillion across households, corporations and governments which is more than 3 times the size of the global economy.

So, can growth assets prices (for property and shares) still go higher from here?

Yes is the answer but don’t trick yourself into thinking that a financial catastrophe will not follow.

Financial catastrophes (such as stock market crashes which are defined as a fall of more than 20% from recent peak) are never a question of if but when.

For investors, the key is to remain invested according to your appetite for volatility and then, when fear and panic take hold during the next financial catastrophe, to take advantage by buying more quality assets at discounted prices.

2 Jul 2019

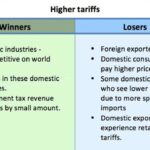

US China Trade War: Greater Bay Area

- Posted by Dejan Pekic BCom DipFP CFP GAICD

China’s Greater Bay Area (GBA) currently has 67.1 million people which will help volt the GBA forward in terms of economic development and expansion.

A big population base plus China’s ongoing mass infrastructure building can only serve to drive its future economic expansion.

Do not see how US tariffs will stop this momentum over the medium or long term because China will just continue to strike new international trade deals.

Click to read.