29 Mar 2018

Business Opportunities: 3 Industries

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The past is history but it is meant to teach us how to take advantage of the present and the future.

The linked piece highlights three business opportunities in the United States for entrepreneurs in the fields of healthcare, medical marijuana and tourism.

Unfortunately, they are not without risk.

Click to read.

22 Mar 2018

Global Financial Crisis: Megacities

- Posted by Dejan Pekic BCom DipFP CFP GAICD

The 2008 GFC (Global Financial Crisis) was a financial catastrophe however the subsequent flood of cheap money from central banks around the World has had a profound impact on all assets prices including fixed interest, stocks and property.

If you look at megacities around the World, residential property prices in London for example have increased from 3 times median earnings to 10 times, Sydney to 12 times and Hong Kong to 19.4 times.

This price increase makes it extremely difficult if not unaffordable for locals to buy property in their own city.

We do not know the timing but asset prices will and do eventually mean revert back to their long term averages which gives investors the opportunity to buy quality assets at discounted prices.

Click to read.

15 Mar 2018

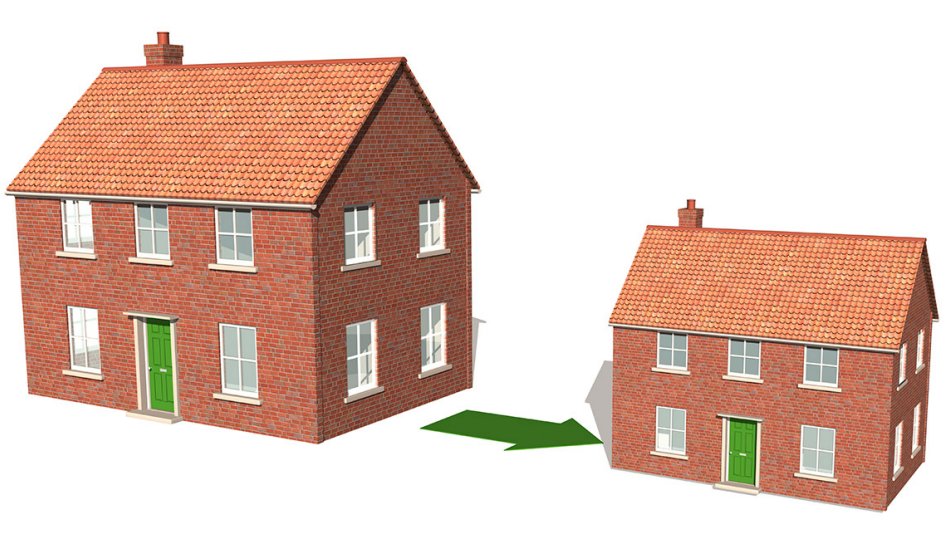

Superannuation Reform: Downsizing

- Posted by Dejan Pekic BCom DipFP CFP GAICD

Downsizer superannuation contribution legislation has been passed which means that from 1st July 2018 (which is only three months away), if you are 65 years old or older you can choose to make a downsizer contribution into superannuation of up to $300,000 from the proceeds of selling your home.

This only applies to the sale of your primary residence and provided that the exchange date (not settlement date) occurs on or after 1st July 2018.

This is an opportunity for clients who do not qualify for the Age Pension because it does not count towards the individual total super balance cap of $1.6 million.

However it will count towards the $1.6m transfer balance cap which means you will still not be able to make more than the maximum initial contribution of $1.6 million into the pension phase of superannuation.

The numbers however are not ideal when it comes to clients who qualify for a part Age Pension.

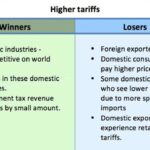

The attached table demonstrates that you what gain in additional income from the downsizer superannuation contribution you lose in Age Pension income due to the increase in assets under the Asset Test.

Click to read.

Yes it is all a challenge to navigate but that is why you have us.

8 Mar 2018

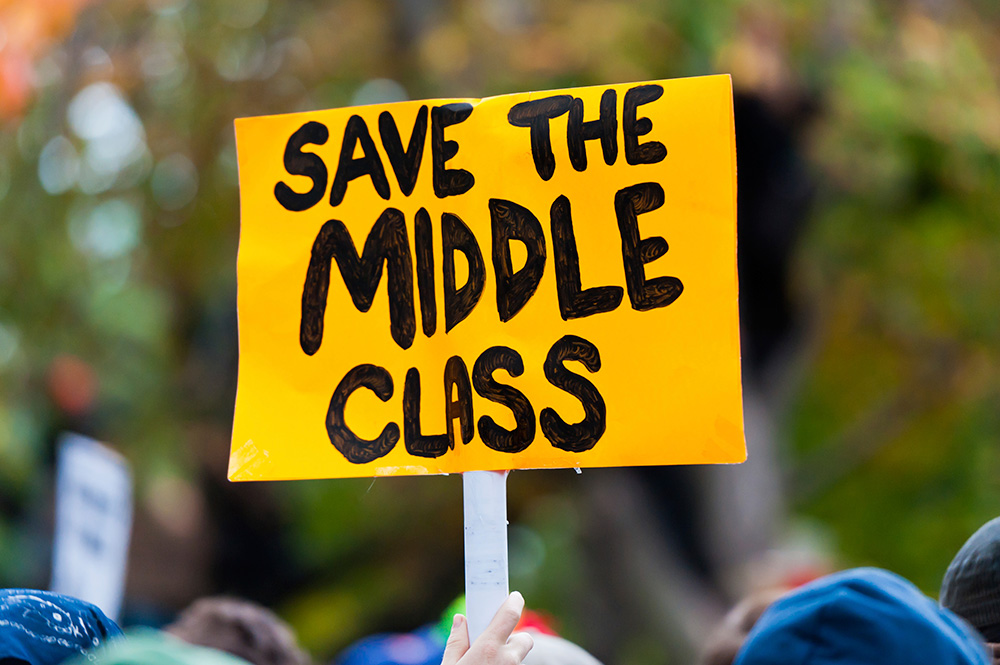

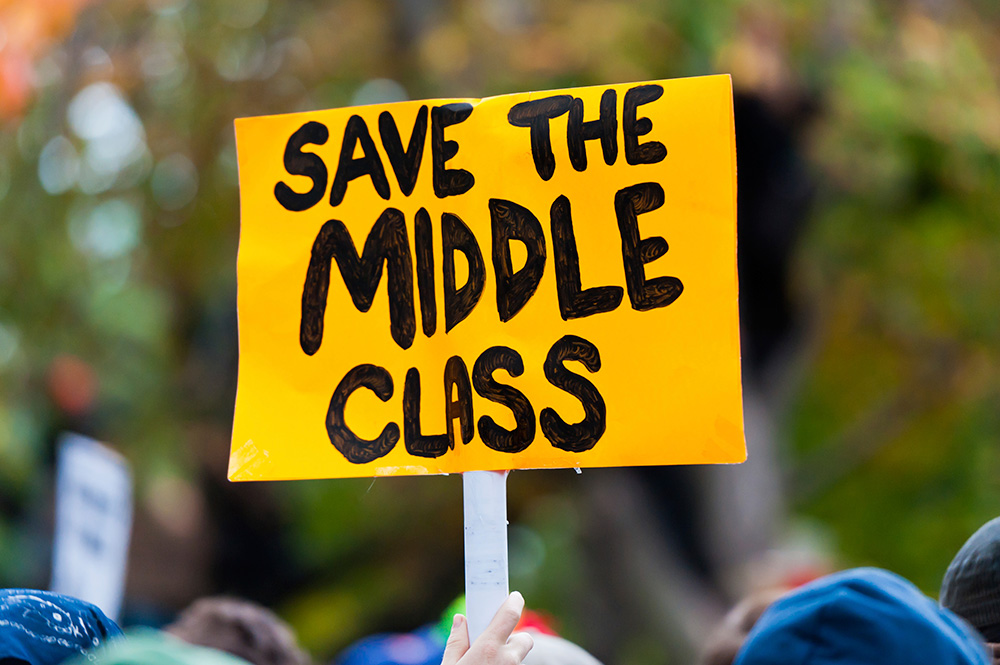

Middle Class Wealth: What went wrong?

- Posted by Dejan Pekic BCom DipFP CFP GAICD

This is an excellent visual story except that it is wrong.

The middle class is disappearing but it is not the fault of business.

It is also not the fault of high net worth individuals who derive their wealth from business.

The fault is squarely with Government.

It is the role of Government to legislate for the people and to ensure that the wealth derived from society by business ultimately finds its way back into our society.

For example, in the United States the Buffett Rule was proposed by President Barack Obama in 2011 which would have applied a minimum tax rate of 30% on all individuals earning more than US$1m a year but it was not legislated. Why?

In Australia and in the United States, business is allowed to make political donations and to lobby Government but business does not vote. Why?

The primary purpose of business is to create wealth for shareholders who are investors.

Business is a good thing, business is necessary for creating prosperity for our society but business is not Government.

Government makes the rules and business will play by the rules and yes business will push the boundaries but ultimately comply with the law.

The problem with the current rules is that without Government legislating change they will continue to lead to greater and greater wealth inequality.

That is a fact.

Click to view.