Financial Services in Sydney from Newealth

At last. A firm with expert financial planners who speak your language, analyse results and advise you regularly.

Your financial success is our goal.

Latest News Posts

Stay up-to-date with the latest from the Newealth news desk.

About Newealth

At Newealth we strongly believe that our true success lies in the success of our clients and our team is dedicated towards helping our clients to achieve their financial goals.

Celebrating 30 Years 1991-2021

A Track Record of Knowledge and Experience

Newealth began trading on September 1st 2000 and was founded by Dejan Pekic. However, our client base was originally established in February 1991.

Meet Dejan More...Meet Dejan Pekic

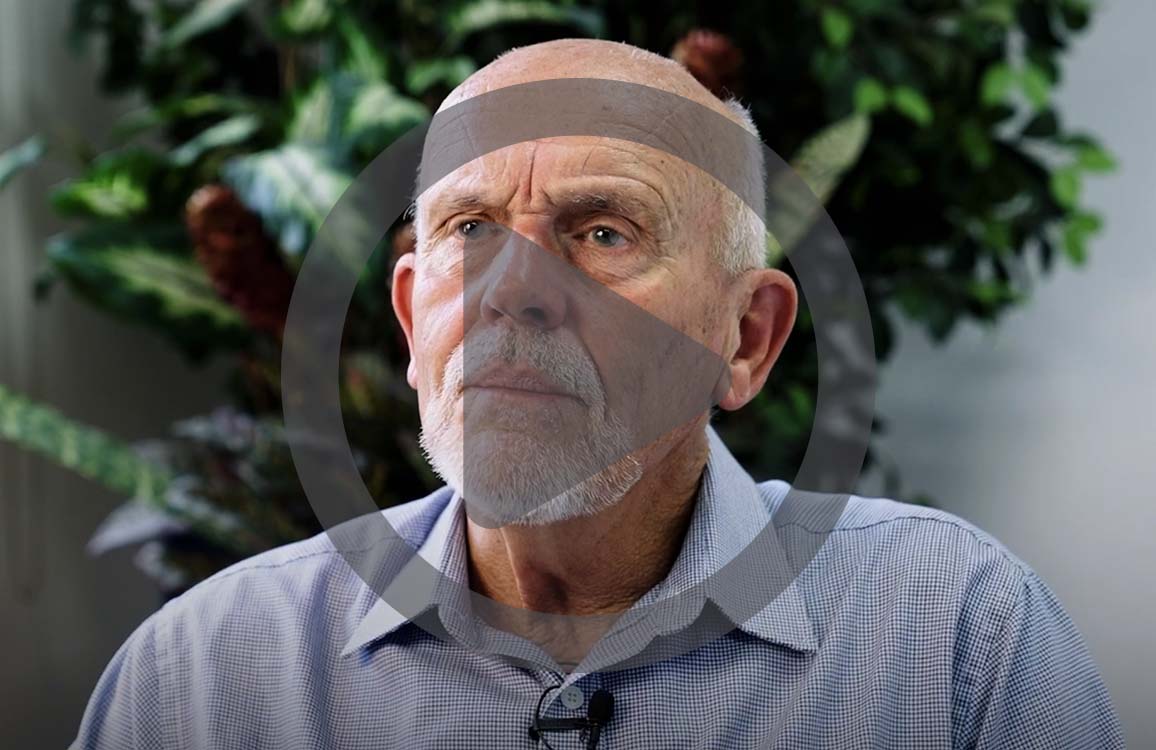

Dejan Pekic

Founder & Senior Financial Planner

Dejan is the founder and principal of Newealth Pty Ltd with over 30 years of experience in all aspects of financial planning and client liaison. He has also qualified for Financial Advice Association Australia's (FAAA) highest level of professional and ethical achievement - a Certified Financial Planner (CFP) in 1997.

Qualifications:

- Bachelor of Commerce (Finance with Merit)

- Diploma of Financial Planning

- Certified Financial Planner

- Certificate IV in Financial Services (Finance/Mortgage Broking)

- Graduate of Company Directors Course

- Ethics and Professionalism in Financial Advice

Our Services

We take a holistic view of your life and combine your personal objectives with our research and expertise to craft a plan tailored to your financial needs and aspirations.

Financial Planning

No buzz words, no jargon: Financial Planning is about making you wealthier and more financially secure.

Newealth provides a single contact point for people from all walks of life and corporate businesses seeking to access a range of Financial Services that can make them wealthier and more secure.

Australian Financial Services Licencee: not licenced by any banks or financial institutions

Learn More: What is Financial Planning?

Learn More: Our Financial Planning Process

Savings & Investment

Optimise your Savings and Investment Strategies to make your dreams a reality.

It doesn't matter whether you're after education for your children, or a trip around the world, or a weekender on the coast. We all have goals that we are working towards. Imagine your peace of mind knowing you have a plan in place to meet these goals.

Savings and investment strategies tailored for you: no 'one size fits all' solution

Long term planning for your long term goals

Learn More: Savings & Investment Strategies

Death & Disability

Don't get caught out: insure your family finances for the tough times.

There is the old saying that two things in life are certain - death and taxes. You get your tax return done every year, although when was the last time you reviewed your insurance cover? We can review you current financial position, look at your personal circumstances and provide you with a comprehensive plan.

We are experienced Risk Management specialists and can review your existing plans

Personalised plans with options from a number of insurance providers

Learn More: Death & Disability Insurance

Super & Retirement

Optimise your superannuation and receive cash dividends throughout your retirement.

If you are still working, superannuation is one of the most tax effective investment options available to you to pay for your retirement - but only if you contribute into it: employee contributions alone limit your options.

Income requirement projections for your retirement dreams

Advice and assistance in choosing a super plan that's right for you

Learn More: Superannuation & Retirement

Need help with your retirement plan?

Get in touch today for an informal obligation-free chat. To make it easier for everyone we'd prefer to chat over the phone, although we can also meet you in our Sydney Office during business hours.

Our Clients

Learn more about how we've helped some of our clients over the years as they share their own stories

Latest News Posts

Stay up-to-date with the latest from the Newealth news desk.

While more Australians are choosing electric vehicles (EVs) each year, upfront costs, infrastructure and range...

Continue Reading...

True wealth isn’t built overnight. It’s built over time with expert financial planning, patience and disci...

Continue Reading...

Recent research published by BloombergNEF indicates global grid investment could top $470 billion in 2025, an ...

Continue Reading...

So, you’ve noticed current market volatility. Having concerns about your investments is normal, but downturn...

Continue Reading...